AITA For My wife quit her job?

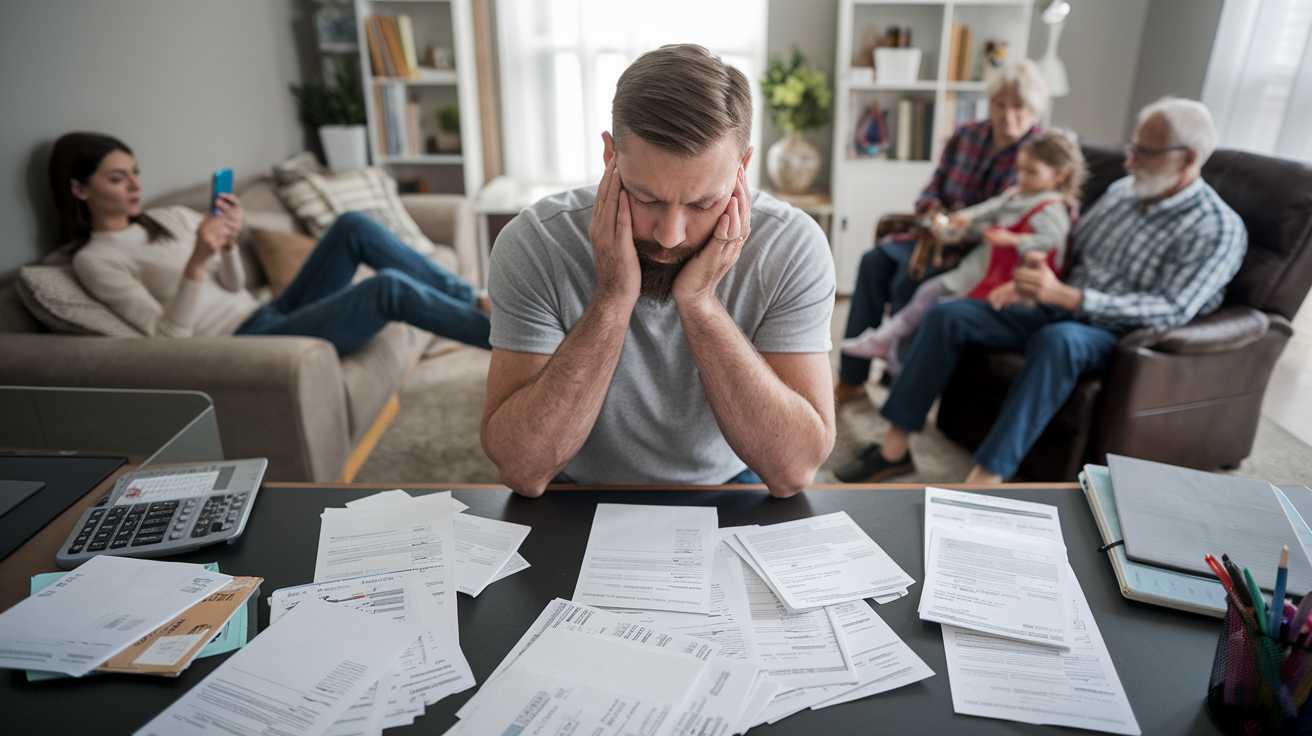

When life takes an unexpected turn, even the most well-laid plans can unravel in surprising ways. In this story, a husband finds himself drowning in financial stress after his wife quit her job—a decision that has left their once-comfortable lifestyle in jeopardy.

Just a few years ago, the couple was pulling in a combined $200k, but things took a drastic turn after refinancing their home and doubling their monthly mortgage payment. Now, with her quitting, the family’s income has nearly been cut in half, leaving the husband shouldering an extra burden while he struggles to make ends meet.

This isn’t just about a job; it’s about promises, priorities, and the often murky waters of marital compromise. While his wife insists she left her job to be a more involved mom, her actions seem to contradict that claim. With their children frequently being passed off to the grandparents and heated discussions over finances, the tension is palpable. As the pressure mounts and their savings dwindle, the husband’s frustration grows. Is he overreacting, or does this situation signal deeper issues in their relationship?

‘ My wife quit her job’

Letting major financial decisions spiral out of control can strain even the strongest relationships. Renowned relationship researcher Dr. John Gottman advises, “Couples who face financial stress together need to communicate openly and treat money matters as a shared project.

Without transparency and teamwork, small issues can quickly evolve into major conflicts.” In this case, the husband is left grappling with a significant income loss after his wife quit her job, and the unresolved issues around her decision have created a rift.

The financial burden has shifted heavily onto him, and his claim that she quit to be more involved as a mom is contradicted by her frequent reliance on her parents to care for the kids. Dr. Gottman notes, “When partners don’t hold each other accountable for shared responsibilities, resentment can build.

It’s important that both parties feel supported and that their contributions are acknowledged.” This imbalance not only creates tension in daily life but also jeopardizes the family’s long-term financial stability.

Another key point raised by financial expert Dave Ramsey is that “Financial decisions in a marriage should be made as a team, especially when significant lifestyle changes are at stake.” In this scenario, the husband feels cornered by the sudden loss of income and the pressure of higher payments following the refinancing.

The lack of clear, constructive dialogue about why she quit and how they could adjust their lifestyle together has left him feeling isolated and overwhelmed. Ultimately, both financial and emotional transparency are crucial. Dr. Gottman emphasizes that “Partners need to actively work on their communication, particularly when finances are involved, to prevent small decisions from snowballing into full-blown crises.”

In this case, the failure to meet halfway and the absence of a collaborative approach to financial management are at the heart of the conflict. His plea for marriage counseling underscores a need for both partners to re-evaluate their roles and responsibilities in navigating these challenges together.

Take a look at the comments from fellow users:

The community overwhelmingly supports the husband. Many feel his wife’s decision to quit her job—and her inconsistent actions as a “stay-at-home mom”—are red flags, forcing him to shoulder an unfair financial burden. They see her behavior as manipulative and believe his frustration is justified, suggesting serious counseling or even drastic measures might be needed.

In the end, this financial tug-of-war isn’t just about one person quitting a job—it’s a wake-up call about communication, accountability, and the need for teamwork in marriage. The husband’s frustration over lost income and increased financial strain, compounded by his wife’s seemingly inconsistent actions, raises serious questions about shared responsibilities and mutual support.

What do you think? Is it fair to demand a partner to shoulder the full weight of their financial choices, or should both partners bear the burden equally? How would you address such a critical issue in your relationship? Share your thoughts and experiences in the comments below.