AITAH for selling my house out from under my son and his girlfriend?

A Redditor found themselves at odds with their son and his girlfriend after deciding to sell a rental home they had occupied for years. Despite giving advanced notice about the sale and even sharing a portion of the profits with her son, the relationship deteriorated. The son and his girlfriend accused her of “selling the house out from under them” and went no-contact, leaving her heartbroken. Was this a fair decision, or did the sale cross a line? Read the full story below.

‘ AITAH for selling my house out from under my son and his girlfriend?’

Expert Opinions

Financial Responsibility & Retirement Planning

Dr. Teresa Ghilarducci, an economist specializing in retirement security, emphasizes that financial planning should always take precedence over emotional attachments. “Parents cannot jeopardize their financial future for adult children. Selling assets for retirement, especially in an unstable housing market, is a rational and necessary choice.”

Ethical and Emotional Considerations

Dr. Joshua Coleman, a psychologist and family dynamics expert, highlights that financial decisions within families often lead to emotional conflicts. “From the child’s perspective, being displaced from a longtime home—especially when they believed they were working toward owning it—can feel like a betrayal, even if no explicit promises were made.” He suggests open, clear communication to manage expectations in financial arrangements between family members.

Market Trends & Homeownership Challenges

Experts note that skyrocketing real estate prices make homeownership increasingly unattainable for younger generations. A 2023 study from the Urban Institute shows that millennials and Gen Z struggle to buy homes due to high costs and stagnant wages. In such markets, selling property at peak value is a logical financial move, though it may create generational friction.

Solutions Proposed by Experts:

- Transparent Financial Planning: Families should set clear expectations about financial arrangements to avoid future misunderstandings.

- Gradual Transitions: If possible, providing longer notice periods and financial guidance can help lessen emotional fallout.

- Alternative Support: Instead of subsidizing housing indefinitely, parents can offer financial literacy resources or co-investment options to help adult children achieve stability.

Here’s the input from the Reddit crowd:

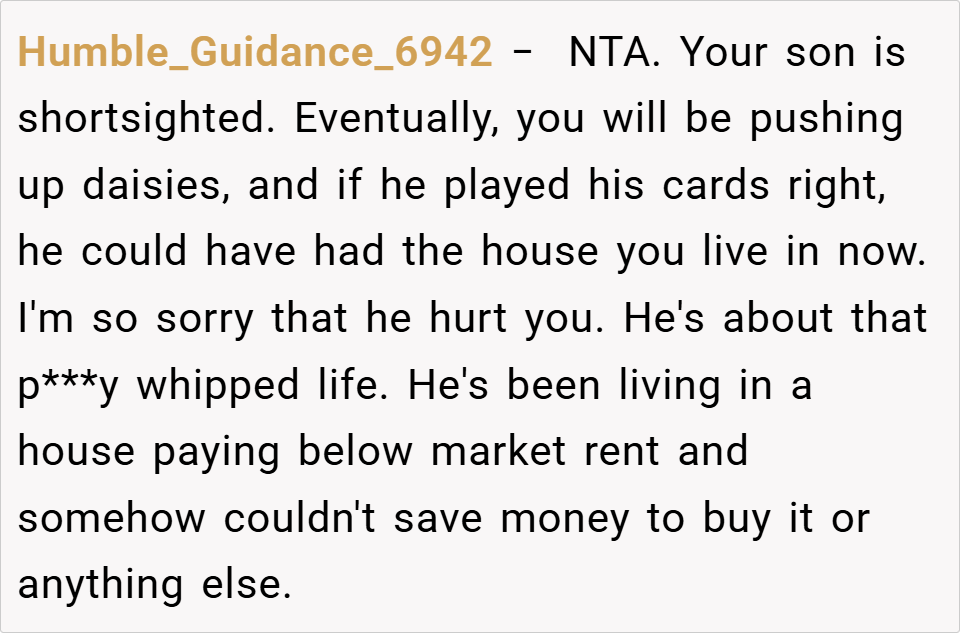

A quick scan of top Reddit comments reveals mixed reactions. Some argue that Joe, as an adult, should have been prepared for the possibility of a sale and made contingency plans. Others empathize with his perspective, believing that familial relationships should involve more compromise and understanding, particularly when major life changes are involved. Many commenters emphasize the importance of clear, upfront communication when mixing family and finances.

When you own something as an investment and the price is right, you sell. She is coming up to retirement, no partner to share future expenses and, who knows what future health prospects she may need to face. She did the sensible thing if she hopes to maintain her independence. Something tells me that her son and his girlfriend would not have been open to providing her with accommodation and full time care should she need it in the future and be unable to pay for it. She is doing all she can to avoid being a future burden to them or being destitute herself.