AITA for separating my finances from my husband because he won’t quit giving his parents money?

After nearly a decade together, one woman’s journey through marital finances has taken an unexpected turn. Once a seamless partnership with two incomes, the dynamics shifted when her husband’s spending habits—and his longstanding practice of loaning money to family—forced her to shoulder the full burden.

The spark that ignited this change was not just the dwindling savings or mounting debts, but the realization that trust and communication were quietly fraying. In a home where money once flowed freely for shared goals, it now seemed to be disappearing into a black hole of familial obligations.

Her story unfolds with a mix of shock, frustration, and a touch of defiant humor. When she discovered hundreds of dollars missing from their savings, the revelation that her husband had unilaterally loaned money to his parents became the final straw. This moment of clarity led her to take decisive action—a move that would not only redefine their financial boundaries but also spark a broader conversation about responsibility, respect, and the delicate balance between family loyalty and self-care.

‘AITA for separating my finances from my husband because he won’t quit giving his parents money?’

When a partner’s financial choices begin to impact household stability, it’s not just a budgeting issue—it’s a signal that deeper communication and trust may be compromised. Financial experts advise that transparency is key in any relationship. In many cases, separating finances is not a sign of mistrust but a proactive strategy to safeguard one’s future. This perspective is especially relevant when one partner consistently mismanages funds that are meant to secure the family’s well-being.

Take, for example, the well-known advice from Dave Ramsey, who famously said, “A budget is telling your money where to go instead of wondering where it went.” His words resonate deeply here, as they emphasize the importance of control and intentionality in money management.

By taking charge of her own finances, our poster isn’t just reacting to lost savings; she’s reclaiming her financial autonomy and laying down a marker for accountability. This proactive approach can be a vital step in protecting not only her personal financial health but also the overall stability of the household.

Delving deeper into the dynamics, it’s evident that differing spending habits can quickly create a rift in any partnership. Financial advisor experts note that when one partner is a saver and the other a spender, it often leads to a silent buildup of tension. Over time, the lack of clear financial boundaries can culminate in drastic actions, as seen here.

The decision to open a new account—effectively locking out a partner from funds earned through hard work—signals a break from a previously shared system. This move, while drastic, is sometimes necessary to prevent further financial harm and to prompt a reevaluation of long-term priorities.

Furthermore, separating finances is not merely a defensive tactic; it’s also an opportunity for honest, sometimes hard, conversations about money management and shared goals. Many experts recommend marital counseling or a joint session with a financial advisor when monetary conflicts become chronic.

Such interventions can help couples establish mutually agreeable budgets, set clear expectations, and, crucially, rebuild trust over time. The focus should be on creating a balanced partnership where both parties feel secure and valued—financially and emotionally. In our poster’s case, these steps might pave the way for a healthier, more transparent future, regardless of whether the relationship continues in its current form.

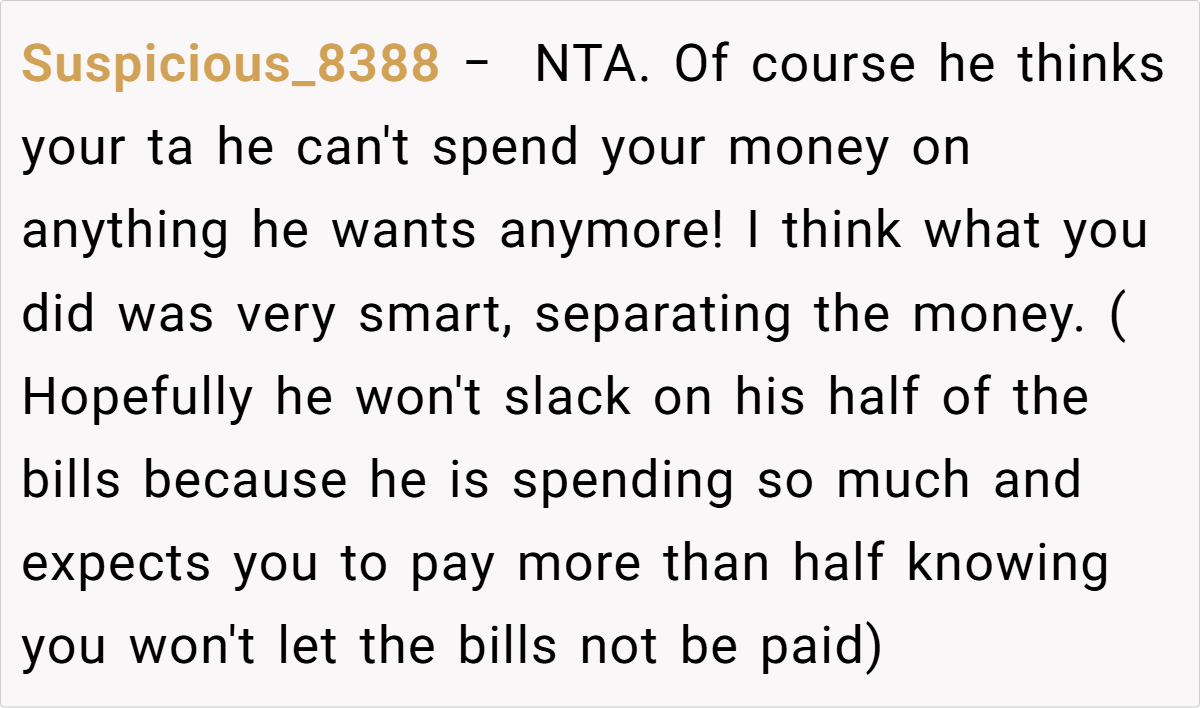

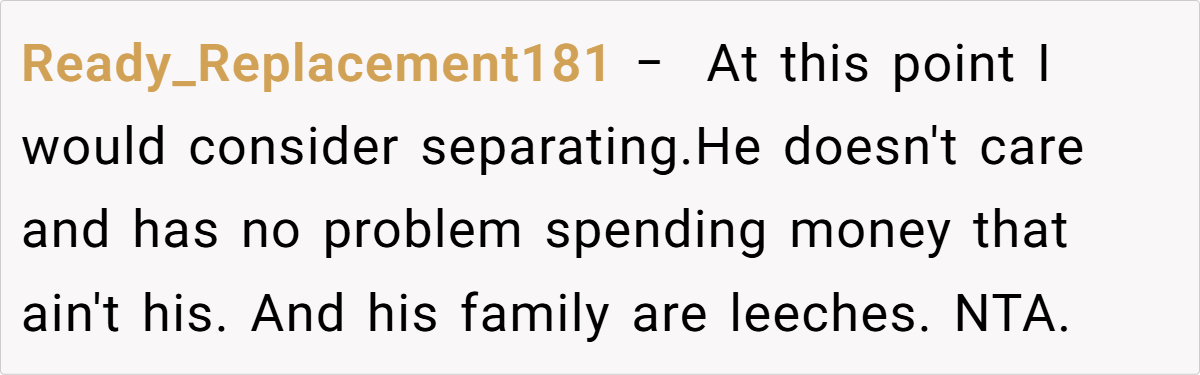

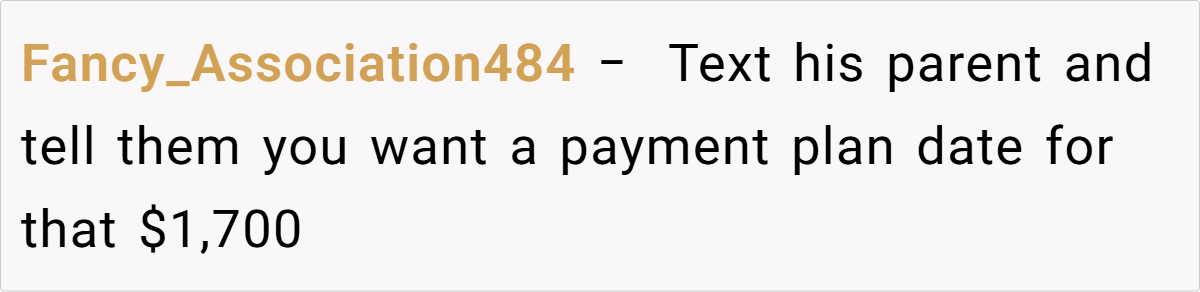

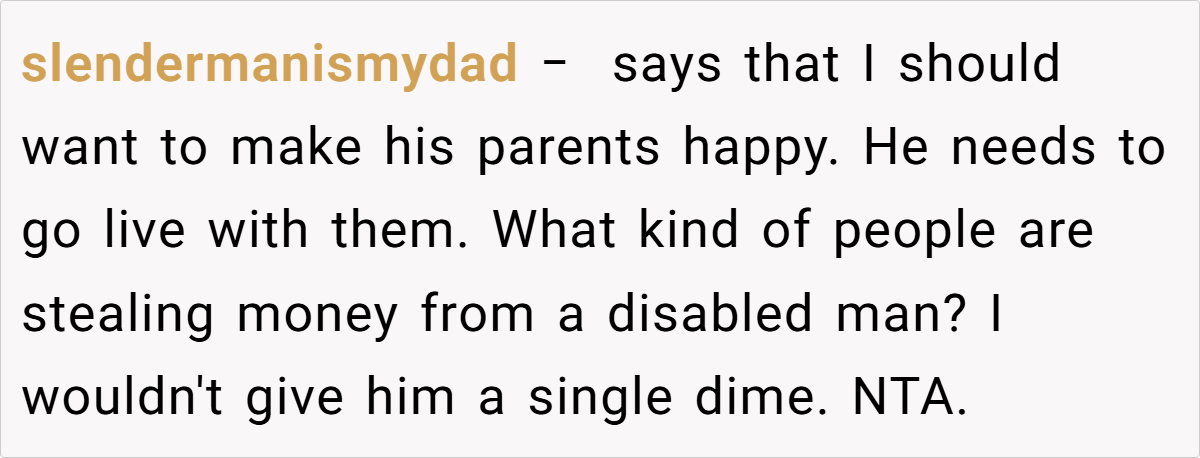

Take a look at the comments from fellow users:

Across Reddit, the consensus is clear: prioritizing one’s financial security is not only justified but necessary when trust is eroded. Commenters largely agree that separating finances can be a prudent decision, especially when one partner repeatedly disregards shared financial commitments.

The community’s tone is both empathetic and pragmatic, with many advising that clear boundaries—and sometimes tough love—are essential. In essence, while many recognize that money issues are deeply personal, they applaud the move to protect what one has worked so hard to build

Ultimately, this story isn’t just about missing dollars—it’s about recognizing the need for financial independence and honest communication in relationships. When money becomes a battleground, stepping back to reassess and protect your resources can be the wisest move. What would you do if you found yourself in a similar situation? Share your experiences and thoughts, and join the conversation on finding balance between family loyalty and self-care.