WIBTA if I back out of helping my sister pay for a car because she went and got a 65k jeep instead of what we originally agreed on?

When family promises collide with unexpected financial decisions, the resulting roadblock can leave everyone in a tailspin. Our story centers on a brother who pledged to help his 18‑year‑old sister purchase an affordable used car for college.

The plan was simple: a modest car within a $25k–$30k range and a commitment to cover the first $5k of monthly payments—a graduation gift to set her on a path of financial independence. However, the journey took an unforeseen detour when his sister and their parents bypassed the original agreement and opted for a flashy, brand‑new Jeep priced at a staggering $65k.

Now, with a car she can barely afford and payments that threaten to derail her financial future, the brother finds himself grappling with betrayal and fiscal responsibility. The situation is as confusing as it is infuriating, leaving him to wonder if he should back out entirely and force a return to the original plan.

‘WIBTA if I back out of helping my sister pay for a car because she went and got a 65k jeep instead of what we originally agreed on?’

Family financial disputes can quickly escalate when promises made in trust are shattered by impulsive decisions. In this case, what began as a supportive gift quickly morphed into a financial quagmire. The initial plan was clearly laid out—a cost-effective car for a college student to rely on without sinking into debt. However, the sudden purchase of a $65k Jeep, financed at a high APR with a down payment far exceeding the agreed budget,

has not only upset the balance of trust but also jeopardized the sister’s financial stability. This decision appears to be more about flash than practicality, risking long-term consequences for someone with no income yet. Deciding to step back from an agreement that no longer reflects realistic financial boundaries is a difficult choice. It highlights the importance of accountability in family financial arrangements.

According to financial expert Dave Ramsey (https://www.daveramsey.com/blog/financial-advice-for-college-students), “Debt is dumb. Cash is king.” His straightforward advice underscores that overspending, especially when it leads to debt before one has even started working, can trap a person in a cycle of financial strain. When family members fail to adhere to agreed budgets, it’s not just a breach of trust—it’s a setup for future hardship.

The expert further suggests that clear communication and strict boundaries are crucial when financial commitments are involved. By backing out or demanding a rollback to the original plan, the brother is not only protecting his own finances but also potentially sparing his sister from unsustainable debt. It’s a call for accountability: if the terms change, so should the support.

He might consider proposing a solution that revisits the initial agreement—perhaps insisting on a return to an affordable car option or even reallocating his funds to a low-risk investment, such as a five-year bond, to safeguard her future while she learns financial responsibility. Ultimately, the situation serves as a cautionary tale about the perils of deviating from a well-considered financial plan.

Family support is invaluable, but it must be paired with sound judgment and mutual respect for agreed terms. Financial decisions made in haste, particularly when influenced by external pressures or impulsive emotions, can leave lasting scars. The brother’s dilemma is a stark reminder that sometimes protecting your own financial future means having the difficult conversation and standing firm on your principles.

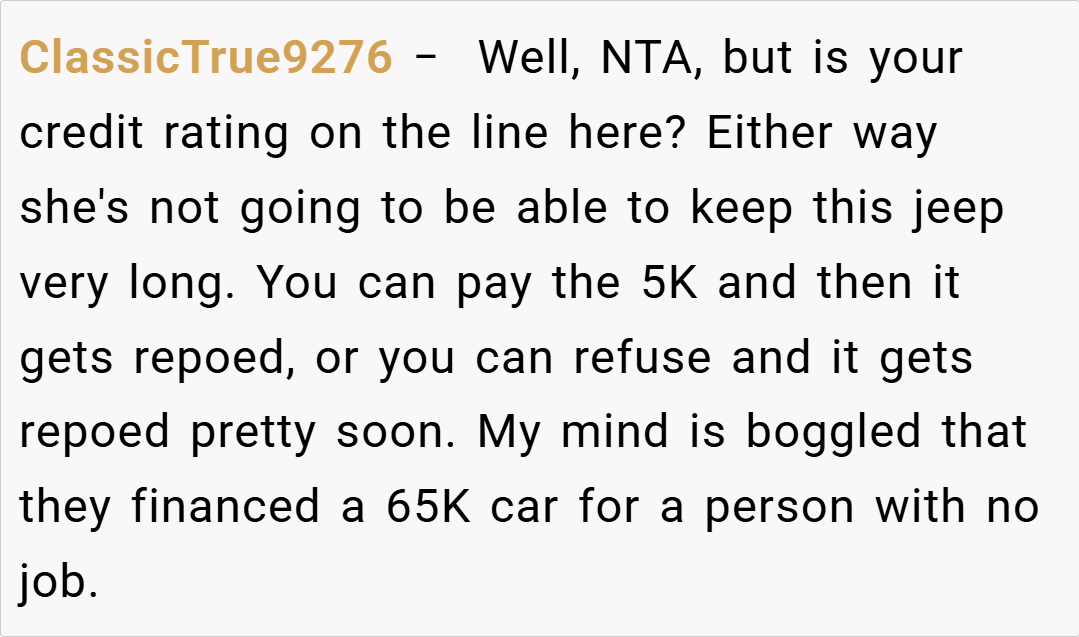

Here’s the input from the Reddit crowd:

Redditors overwhelmingly agree that backing out is the right call. They criticize the parents for setting up a financially doomed situation and commend the brother for standing up against impractical spending. The consensus is clear: if your family can’t stick to the plan, you’re under no obligation to pick up the tab for a financial trainwreck.

This story is a vivid illustration of how even the best intentions can go astray when clear financial boundaries are ignored. When promises turn into extravagant missteps, the resulting fallout can jeopardize both trust and fiscal stability. Would you continue to support a plan that has been unilaterally changed, or would you draw a firm line to protect your financial future? Share your thoughts and experiences—let’s discuss how to navigate family finances when promises derail and dreams hit the brakes.