What is a W2 Contract Job? Tips & Benefits of W2 Jobs

This project is not part of the daily tasks of a company’s regular employees. Companies hire W2 contract employees and give them tasks similar to that of regular employees. The primary dissimilarity lies in the fact that W2 contract employees do not benefit from routine employees. A W2 contract refers to a document signed by a worker, their work agency or staffing company, and another company.

- Second, as a W2 employee, your employer will be responsible for withholding taxes from your paycheck and paying them to the appropriate government agencies.

- (7) The amount of tips an employee reported to their company for that year.

- Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease.

- Therefore, at the end of the year, theoretically, you won’t owe anything back to the government.

- Especially since many in your network are HE and this happened to me in HE.

- A W2 worker can become a more flexible worker than a regular employee.

Does DoorDash Take Cash? DoorDash Payment Methods

Of course, the specific benefits available to you will depend on your employer and the terms of your employment, but being a full-time employee can provide a foundation for a stable and rewarding career. A 1099 worker is generally a shorter term commitment than a W2 employee. I’ve used the term “worker” throughout this article intentionally; 1099 workers are hired to do a well-defined job. It’s much easier to terminate a 1099 worker because you can simply say you don’t want to pay them for the Bookkeeping for Veterinarians work anymore.

W2 Contract (W2 EMPLOYEE Meaning?)

But he may also accept multiple projects from the same or another company. However, they have to include a W3 form, which serves as a transmittal form, indicating a summary of all the W2 documents for submission. Like Copy 1, you should give Part 2 to the city, state, or locality.

- But you must gain the necessary knowledge before accepting any employment opportunity, especially if you are an international student pursuing education in the USA.

- It’s a road that could lead to exciting benefits, making it a ride worth considering for anyone hunting for more than just a job, but a place to belong and grow.

- W2 employees are generally considered to be the most traditional form of employment.

- The recruitment or placement agency gets paid by their end client for their services, which include finding new candidates, scheduling interviews, etc.

- In recent years, the DOL has proposed multiple rulings that would have changed its standards for determining whether an individual qualifies as an employee or an independent contractor.

Determining If A Position Should Be W2 or 1099

Stick around, and you’ll discover why jumping into a W2 position might just be the smartest move you make. Finally, it is important to note that not all workers are classified as W2 employees. Independent contractors, for example, are typically classified as 1099 workers, which means that they are responsible for paying their own taxes and do not receive benefits or protections as employees.

Is W2 a good fit for your business?

Beyond retention, W2 employees should (in my opinion) have a long-term benefit to the company. In addition to completing the work they were hired to do, they can continue to grow their skills and contribute at a higher level over time. Unlike a 1099 worker, W2 employees cost a business much more than their annual salary because the employer pays a share of taxes, benefits, and equipment. The expense of a W2 employee can vary based on the state where the business is located and where the employee lives (this can be a hidden cost of remote work for some businesses). Always make sure the information provided about you, the company, the income you received, and the taxes you paid are correct.

- Additionally, there is a comparison between W2 contracts and full-time employment.

- Whether you’re a seasoned professional looking for a change of pace or a new grad eager to gain experience, a W2 contract role might be just the ticket.

- Additionally, the employer withholds taxes from their paychecks, simplifying their tax filing process.

- Contingent workers are people whom a company engages for a fixed period.

- I know this article is addressing new employment, but I wanted to see what thoughts or experiences are around a W2 employee receiving a bonus classified as a 1099.

- If you haven’t received this form yet and it’s past January 31st, reach out to your work’s payroll department to see what’s going on.

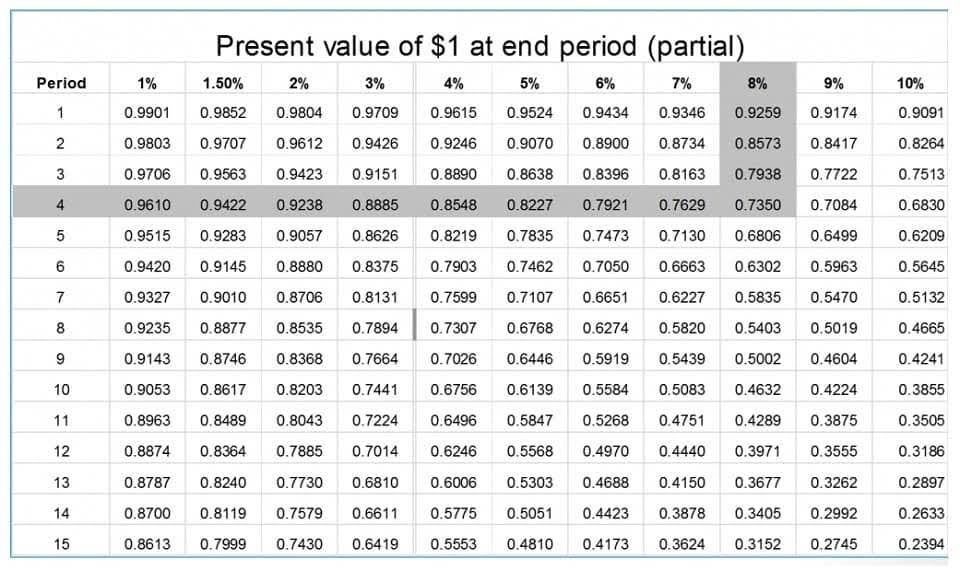

The IRS deducts them from both the employee and employer during an employee’s work years. Use this box to report other information given to the employee (for example, state willing to work on w2 disability insurance taxes withheld). As an employee in the United States, there are different types of work arrangements available to you.

What is the difference between a W-2 employee and a W-2 contractor?

A W2 consultant means a person who is hired by a staffing agency (an employee) but working temporarily in a designated company (contractor) who is payroll the client of the staffing agency. The candidate, on clearing the interview, will begin to work for the ‘XYZ’ company. Unlike, W2 employees, C2C consultants don’t have job security or chances of getting a contract IT job converted to full-time employment. In fact, if you have joined an organization through a recruiter, the spoiling of relations between the two can also affect your contract. Form W-2 (Wage and Tax Statement) is a tax form that reports the amount of money an employer pays an employee per annum and the amount of income tax they withhold from this amount for the IRS. 💡The equivalent of the W-2 tax form for independent contractors is the 1099-MISC.