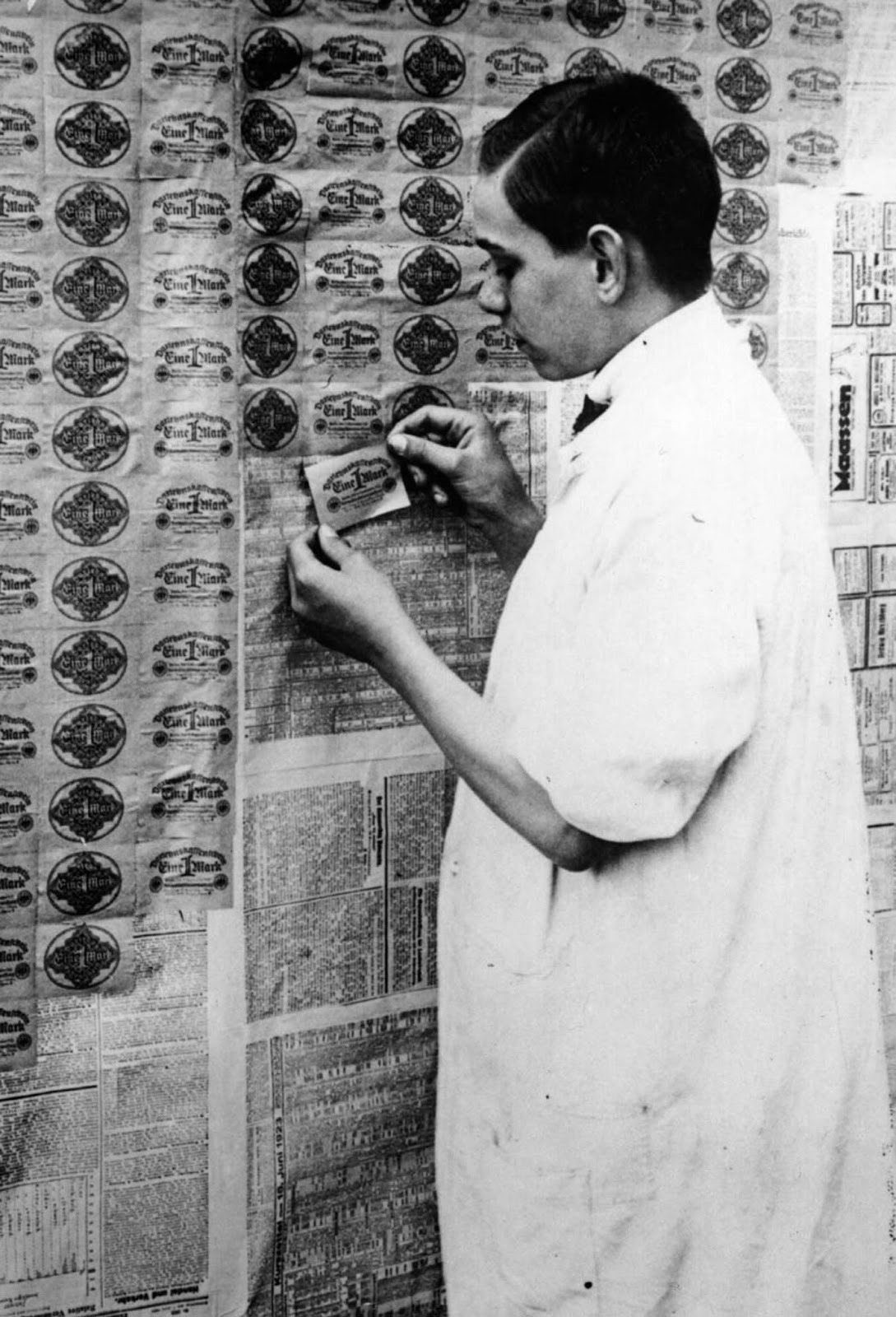

Hyperinflation Hit Germany In 1923: How Banknotes Became Wallpaper

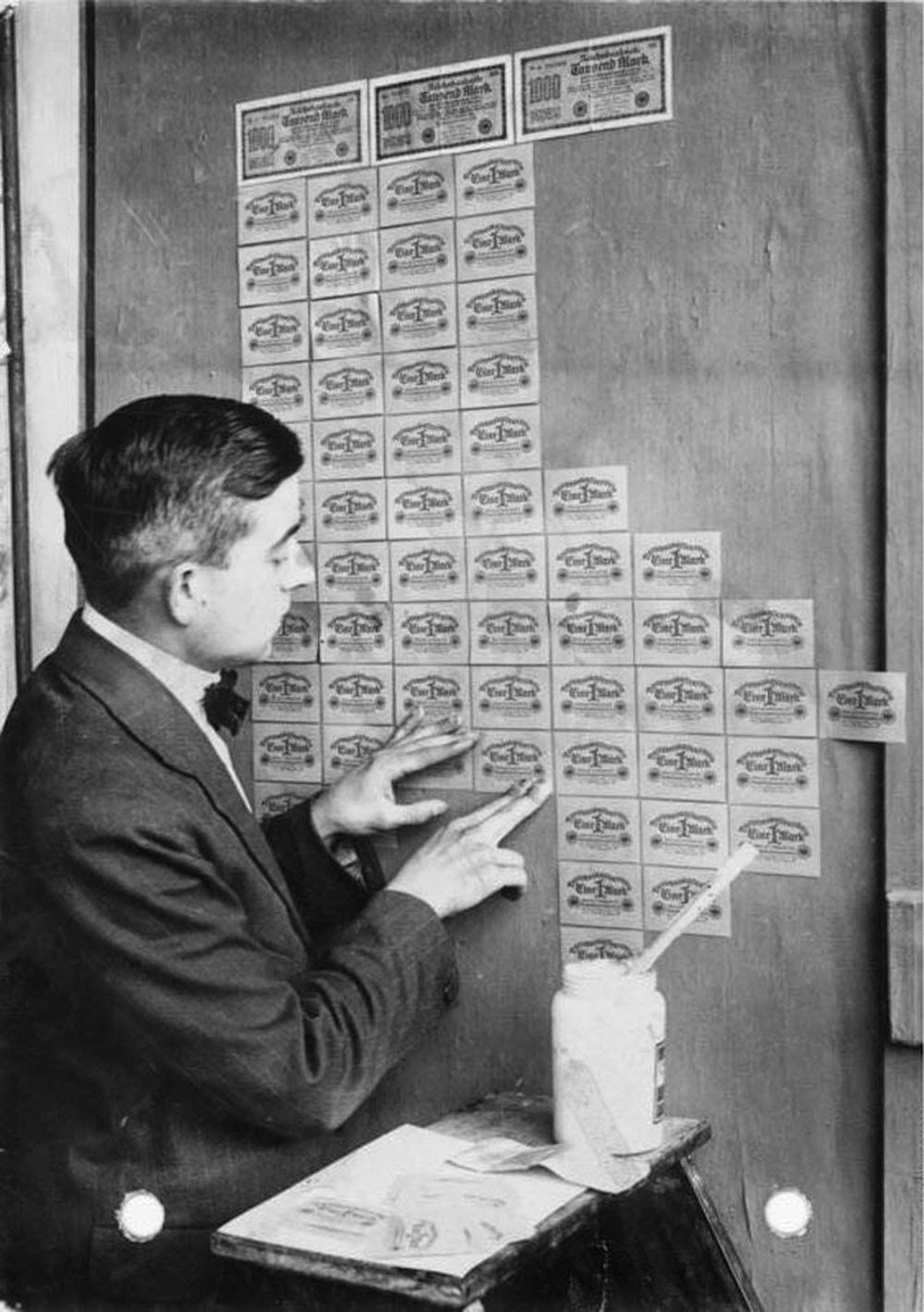

How would you feel if you woke up one morning and found that your entire life savings couldn’t even buy you a loaf of bread? For the people of Germany in 1923, this nightmare became their reality.

The German Mark, once a stable and respected currency, had spiraled into worthlessness. In just a few short years, the economic landscape transformed from one of prosperity to sheer chaos, with prices doubling overnight and a loaf of bread costing billions of Marks.

This is the story of how hyperinflation gripped Germany, leaving behind not just economic ruin but a scarred national psyche that would later be exploited by the forces of extremism.

Germany Before the Storm

Before the horrors of World War I, Germany was a nation thriving with prosperity. The German Mark was as strong as the British shilling or the French franc, and the country was a world leader in optics, chemicals, and machinery.

Germans lived comfortably, with a gold-backed currency that ensured their wealth was secure.

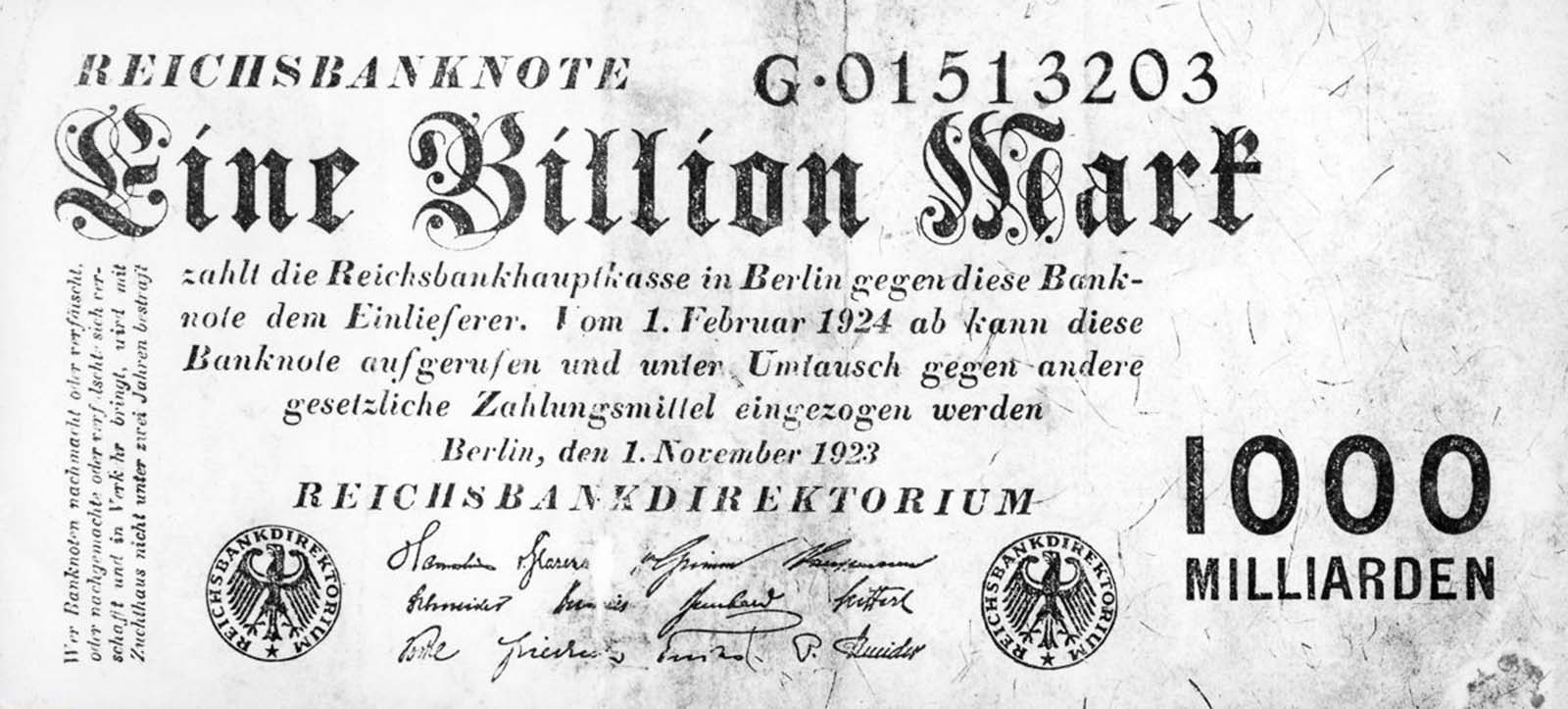

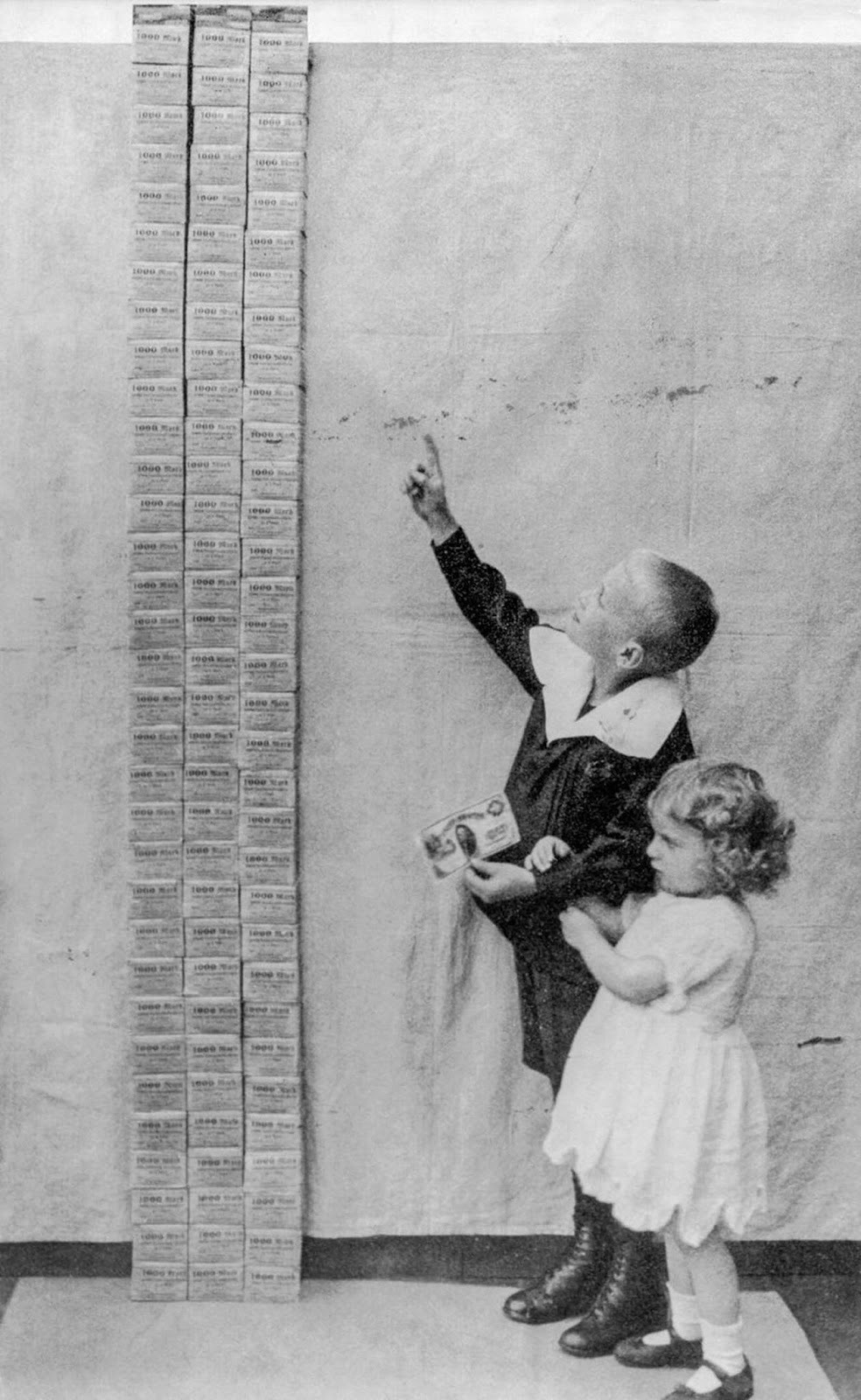

In 1914, one could exchange four or five Marks for a dollar. But by 1923, at the peak of hyperinflation, that exchange rate had ballooned to one trillion Marks to a single dollar.

This dramatic shift left most Germans stunned as they watched the value of their hard-earned money evaporate before their eyes.

Walter Levy, a German-born oil consultant, recounted a personal story that captures the essence of this financial disaster. His father, a diligent lawyer, had taken out an insurance policy in 1903 and faithfully paid into it for 20 years.

When it finally matured in 1923, he could only afford to buy a single loaf of bread with the payout. This was the harsh reality of life in Germany during those years.

The Road to Ruin

The seeds of Germany’s hyperinflation were sown during World War I. In 1914, the country abandoned the gold standard, and instead of financing the war through savings and taxation, the government borrowed extensively.

The war dragged on far longer than expected, and by 1919, prices in Germany had already doubled.

Germany’s defeat in the war only exacerbated the situation. Under the Treaty of Versailles, the country was burdened with enormous reparations payments, demanded in gold-backed Marks.

The Weimar Republic, established after the war, was politically fragile and struggled to meet these demands. The loss of the Ruhr and Upper Silesia, key industrial regions, further weakened the economy.

Yet, despite these warning signs, ordinary Germans clung to the belief that life would return to normal. They continued working, sending their children to school, and planning for the future, even as prices began to skyrocket.

From 1914 to 1919, prices doubled; by 1922, they were doubling again in mere months.

As the cost of living soared, the middle class found themselves squeezed, and an underground economy emerged as people sought to evade taxes and survive the escalating prices.

The Financial Freefall

On June 24, 1922, the assassination of Walter Rathenau, Germany’s moderate foreign minister, sent shockwaves through the nation. Rathenau was a charismatic figure, and his murder by right-wing extremists shattered the faith of many Germans.

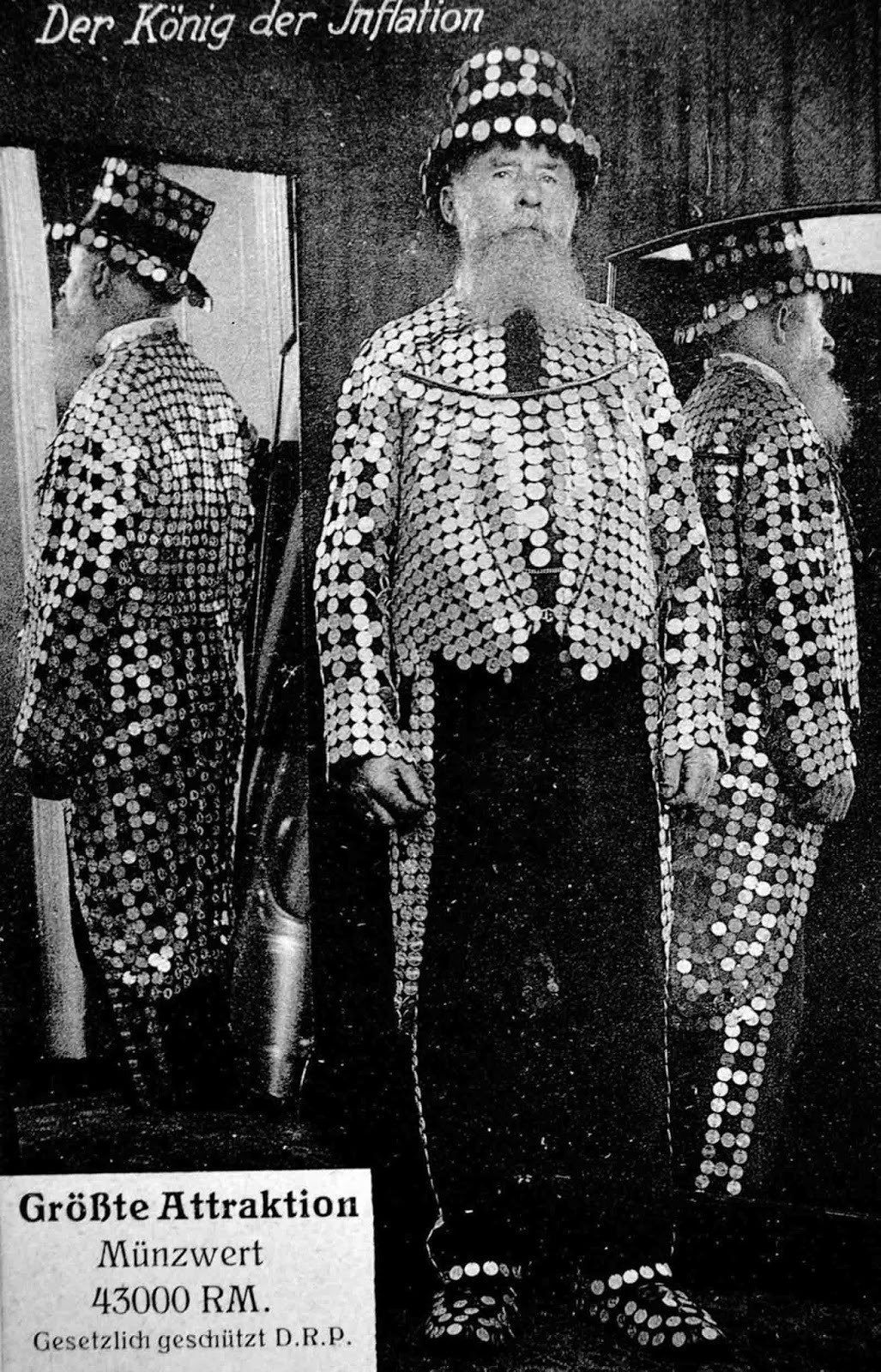

His state funeral marked a turning point, as the already jittery citizens of the Ruhr began converting their savings into tangible goods—diamonds, art, real estate—fearing the worst was yet to come.

As prices continued to climb, the German Central Bank struggled to keep up with the demand for currency. The bank’s president, Dr. Rudolf Havenstein, delayed buying a new suit as he thought that prices would soon fall.

Meanwhile, local governments began issuing their own currencies, and the entire nation plunged into financial chaos.

The desperation was palpable. Factory workers were paid daily, rushing to spend their wages before they lost value. Teachers handed their pay to relatives who would dash to the nearest shops.

Banks closed early, unable to cope with the frantic demand. And as money lost its meaning, people resorted to barter, trading anything they could get their hands on—shoes for shirts, crockery for coffee.

Hyperinflation’s Toll on Society

By November 1923, Germany’s currency had completely collapsed. One dollar was now worth one trillion Marks, and the once-strong economy lay in ruins. The impact on everyday life was profound.

With the collapse of the Mark, the lifetime savings of millions were wiped out overnight. Widows who relied on insurance payouts were left destitute, and marriages were called off as brides could no longer bring the customary dowry.

The moral and ethical values that had once underpinned German society were eroded. As novelist Thomas Mann observed, the market woman demanded 100 million Marks for an egg.

The insanity and cruelty of hyperinflation had numbed the nation, and nothing seemed shocking anymore.

Pearl Buck, the American author, witnessed this devastation firsthand. She later wrote of the millions who had lost their fortunes and savings, describing them as “dazed and inflation-shocked” and no longer able to understand how they had been defeated.

They had lost not just their money but their self-assurance and belief that hard work could secure their futures.

The Miracle of the Rentenmark

Just as the country teetered on the brink of total collapse, the Rentenmark was introduced in late 1923.

Horace Greeley Hjalmar Schacht, the new president of the Reichsbank, executed the plan that would restore some semblance of normalcy to Germany’s financial system.

The Rentenmark was backed by mortgages on land and bonds on factories, though this backing was largely symbolic.

What truly mattered was the belief that the German people placed in the new currency. Remarkably, they did believe, and the economy began to function again.

But the damage had been done. The savings lost during the hyperinflation were never recovered, and the values of hard work and decency that had once characterized German society were forever altered. A new, darker mood had taken hold.