AITAH for not covering my wife’s cousin’s losses at the casino?

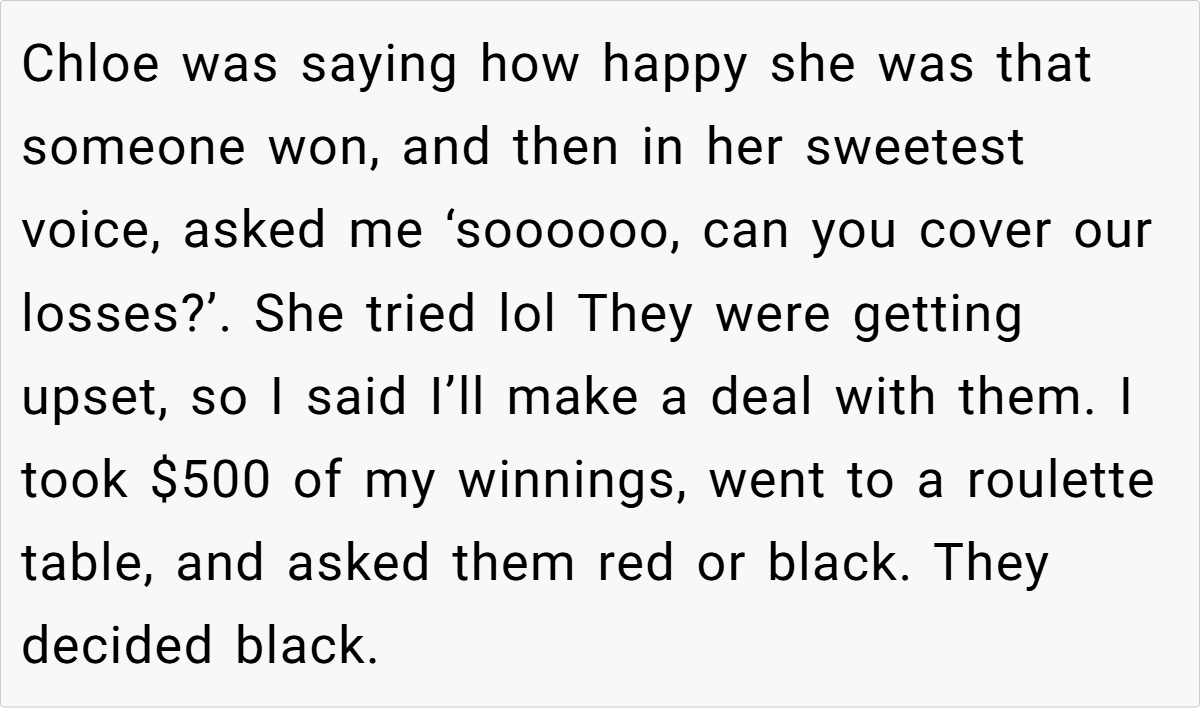

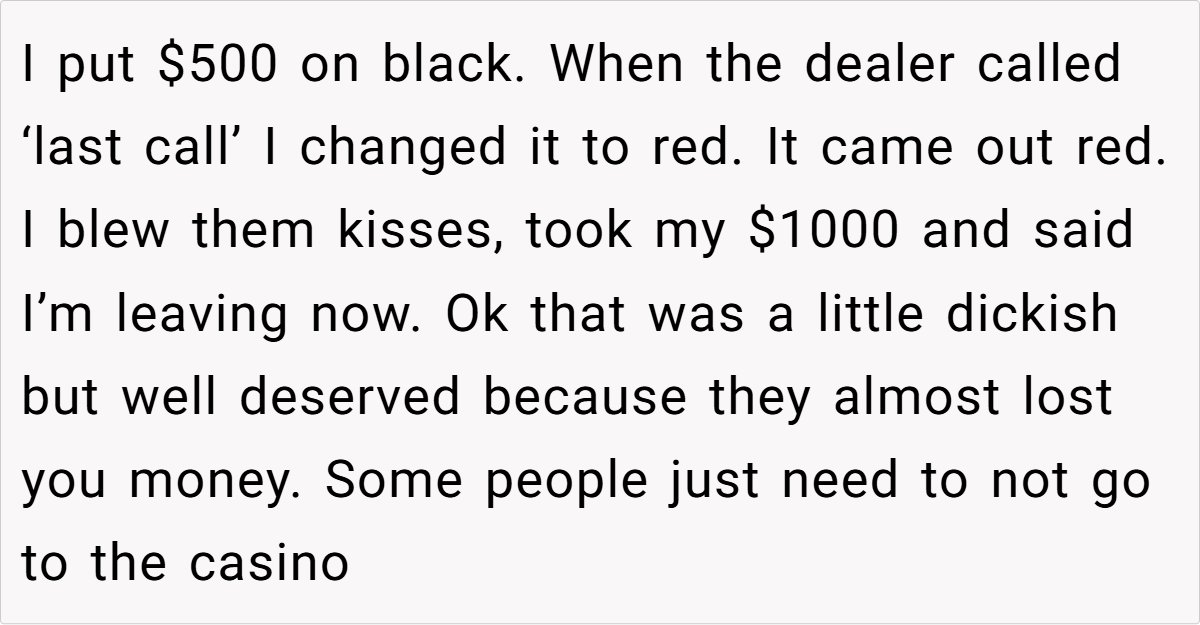

Family and money often create unexpected drama, and this update is no exception. In this story, a 29-year-old man recounts a weekend at the casino that turned into a lesson in financial boundaries with his wife’s cousins. While he was celebrating a big win, his wife’s cousins took the opportunity to ask him to cover their losses.

Their expectation, based solely on their familial connection and his good fortune, led to a confrontation that left everyone with mixed feelings. Is it fair to expect someone to bail you out of your own losses, even if you’re family?

‘AITAH for not covering my wife’s cousin’s losses at the casino?’

When money and family intersect, the boundaries of obligation can become blurry. Financial expert Dr. Laura Markham points out, “While helping family in times of need is admirable, it’s important to maintain clear boundaries so that financial decisions remain healthy and sustainable.”

In this case, the narrator’s impressive casino win was a personal achievement and not a communal pot meant for covering losses. The cousins’ request to use his winnings as a bailout reflects an unhealthy expectation that personal success automatically entails a duty to offset others’ gambling losses.

Such expectations can strain relationships, as financial independence should not translate into unwarranted financial support. Professionals suggest that clear communication about boundaries and personal finances is essential to prevent resentment. Ultimately, while empathy is valuable, financial responsibility rests with each individual.

Here’s the feedback from the Reddit community:

Many redditors sympathize with the narrator, arguing that winning money is a personal achievement and that no one is entitled to expect a bailout. Others claim that family should help each other out in tough times, but they also agree that this doesn’t extend to bailing out irresponsible gambling habits. The discussion highlights a split between those who prioritize individual financial responsibility and those who see family as a safety net.

In conclusion, this update raises an important question about where we draw the line between familial support and personal accountability. The narrator’s refusal to cover his wife’s cousins’ losses—despite his own big win—underscores the need for healthy financial boundaries, even among family members.

Is it fair to expect someone to pay for your losses just because you’re related? What would you do in a similar situation? Share your thoughts, experiences, and advice below to help us all navigate the complex interplay between family loyalty and financial independence.