AITA for telling my sister no when asked for money…again?

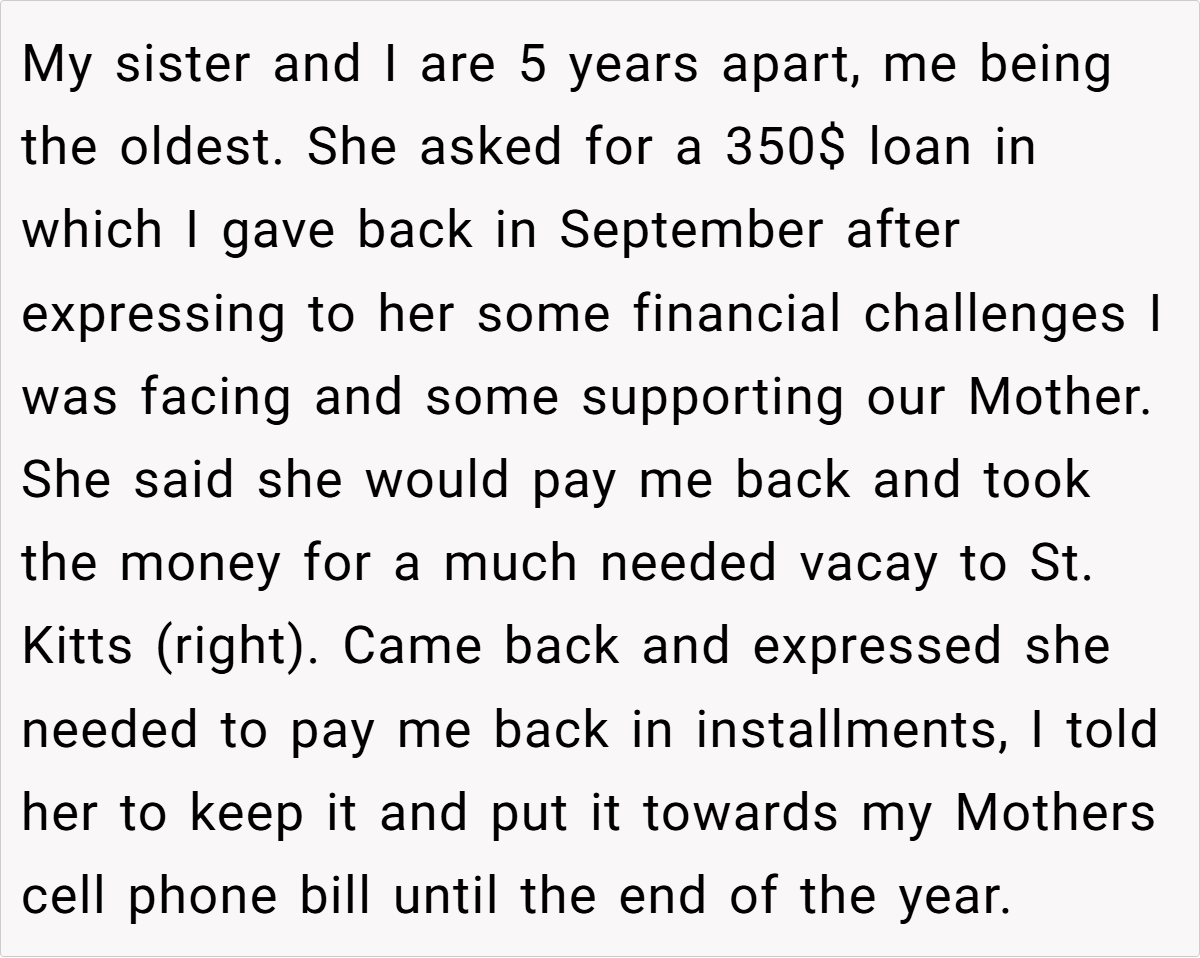

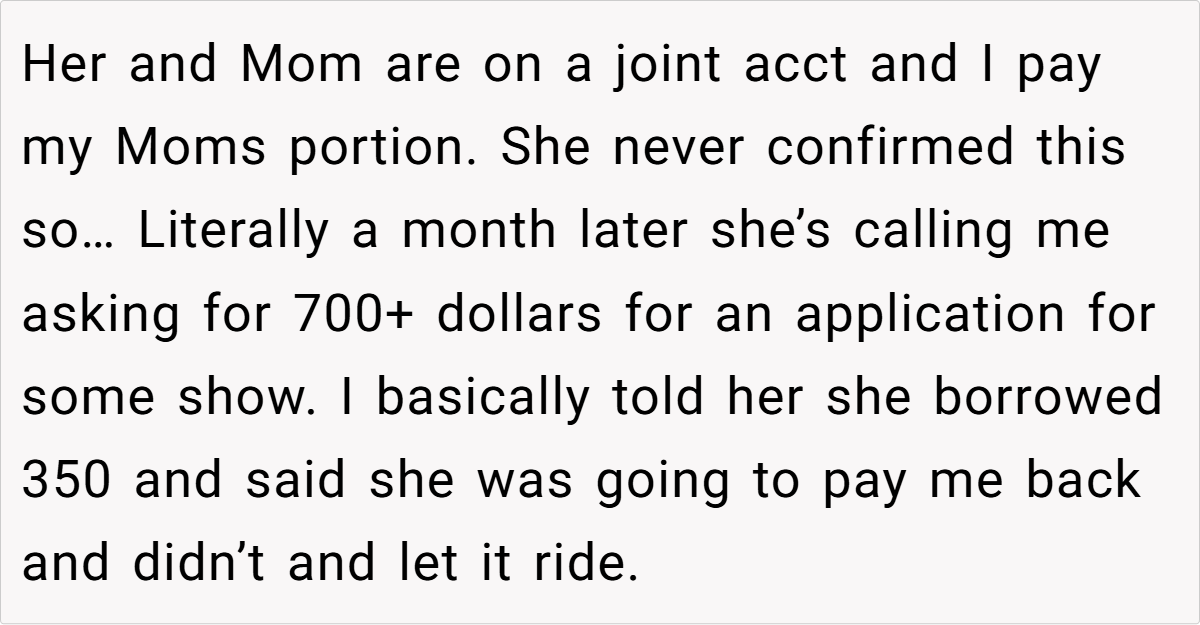

Money between family members can be a tricky business—especially when emotions, unspoken expectations, and day-to-day realities all converge. In this story, our narrator, an older sibling, wrestles with a younger sister’s repeated requests for cash. At first, the older sister caves in and offers a loan of $350. Then the sister returns from vacation only to ask for an even bigger sum—$700—for yet another pursuit. That’s when the older sibling draws the line, setting off a silent rift between them.

The tension only deepens when the younger sister abruptly pays back the $350 and goes radio-silent for Thanksgiving. Now, our narrator questions if standing firm on financial boundaries—and refusing to follow up or mend fences—makes them the villain. Let’s see how this family drama unfolds, and whether there’s any hope for reconciliation.

‘ AITA for telling my sister no when asked for money…again?’

Expert Opinion

“Family loans can create hidden layers of resentment,” observes Dr. Terri Orbuch, a psychologist featured in Women’s Health. In this scenario, the older sister tried to help a family member in need. Initially, it seemed like a simple act of support—until new financial demands emerged soon after. Such repeated borrowing can strain relationships, especially if the borrower shows little initiative toward repayment or gratitude. According to Dr. Orbuch, consistent communication and clear boundaries are essential when money exchanges hands among relatives.

When loans blend with emotional needs—like wanting to escape financial stress or enjoy a much-needed getaway—tensions mount. The younger sister’s call for a vacation loan might have signaled deeper issues with her budgeting or personal priorities. Dr. Orbuch suggests that loved ones who lend money do so with explicit terms: a signed note, a repayment schedule, or at least a frank conversation about timelines. This clarity can help manage misunderstandings and maintain trust in the long run.

Moreover, the older sister’s frustration hints at a broader family dynamic: guilt and responsibility. She’s already supporting their mother, so being asked to fund a trip and more feels like a double burden. Dr. Orbuch underscores that it’s okay—even healthy—for relatives to say “no” when requests for financial help start crossing personal limits. True support doesn’t necessarily mean endless handouts; it can also mean encouraging the other person to seek practical solutions, like finding side gigs or reevaluating expenses.

Finally, the niece’s withdrawal—skipping Thanksgiving calls and avoiding contact—might reflect either embarrassment or anger. According to Dr. Orbuch, open and non-accusatory dialogue can often mend these rifts. The older sister could express that she values their relationship but also needs financial respect. Whether or not they reconcile, setting boundaries helps both parties move forward with clearer expectations and, hopefully, less tension around money matters.

Here’s what people had to say to OP:

Readers largely sympathized with the older sister, pointing out that she already offered financial help but was met with repeated requests and little accountability from the younger sibling. Some felt the sister had been more than fair, noting it’s not her responsibility to fund vacations or uncertain projects.

Others suggested direct communication or stronger boundaries to avoid future misunderstandings. Overall, commenters supported her decision to refuse additional loans and focus on her own well-being, emphasizing that family ties don’t obligate endless financial support.