AITA for not splitting my finances with my husband?

In a marriage, finances are often touted as a “shared responsibility,” but what happens when one partner’s income streams and personal passions are distinct from the joint household funds? In this post, a 25-year-old woman explains how she and her husband agreed on splitting their monthly expenses until marriage—and then the dynamics shifted.

Even though she owns their apartment, has a full-time job, and earns slightly more than her husband, she also runs a side hustle as a dedicated collector. Spending her early mornings at flea markets and restoring “junk” into collectibles that she later sells on eBay, she uses that income exclusively to invest in her passion.

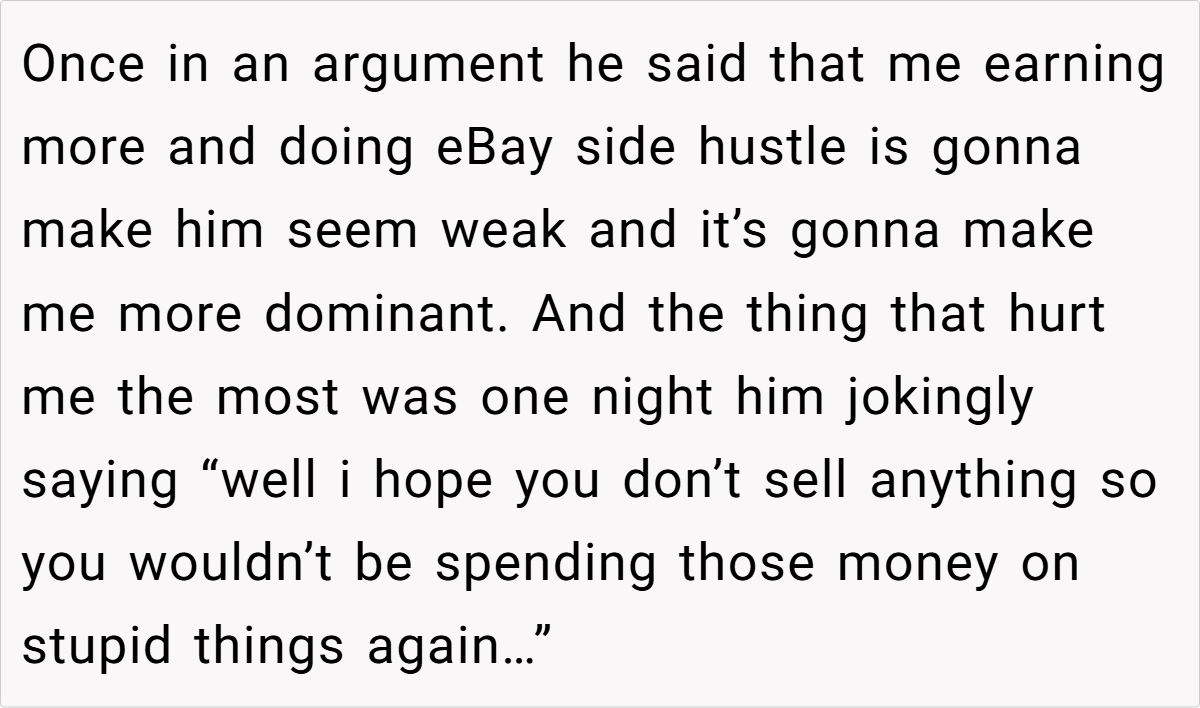

However, what began as an understood arrangement before marriage has become a point of contention. Her husband, who knew about her collecting habits during their seven-year relationship, now reacts with anger and control whenever she makes a purchase or when her eBay sales come through.

His insistence on monitoring her side income—and even his disappointment when her mother pays for a collectible—has left her feeling judged and threatened in her personal space. This post raises the question: Is she really in the wrong for keeping her side hustle finances separate from their shared money?

‘AITA for not splitting my finances with my husband?’

Balancing personal passion with shared financial responsibilities is a delicate art in any marriage. In cases like this, where one partner has a distinct source of income dedicated solely to personal investments, clear communication and mutually agreed boundaries are crucial. Relationship and financial experts argue that maintaining separate finances for personal endeavors is not inherently selfish—it can be a healthy way to preserve individuality within a partnership.

Dr. John Gottman, a well-known relationship expert, notes, “Successful marriages honor the balance between shared responsibilities and individual passions. When both partners agree on financial boundaries, each can pursue personal goals without jeopardizing the shared vision of their life together.”

Although his work often focuses on broader relational dynamics, this principle is directly applicable here. The OP’s side hustle, which fuels her passion for collecting and restoration, was a known factor before marriage and should ideally remain a personal domain if both partners have agreed to it.

The issue arises when one partner uses control and criticism to infringe on the other’s financial autonomy. While it’s reasonable for couples to discuss and plan for shared expenses, forcing a partner to merge income streams—especially income earned from personal ventures—can lead to resentment and power imbalances. In this case, the husband’s behavior appears to be less about household budgeting and more about exerting control over an area that is both a creative outlet and a financial asset for his wife.

Moreover, when family members or close partners begin to police these separate income sources, it can erode trust. Transparent communication is the antidote: couples need to revisit their pre-marriage agreements and, if necessary, adjust them together. For instance, a monthly “financial check-in” might allow both partners to express their concerns while also celebrating individual successes. Ultimately, maintaining individual financial projects—even when married—can foster a sense of independence that benefits the relationship overall.

Here’s how people reacted to the post:

Here are some hot takes from the Reddit community—candid, humorous, and full of unexpected insights. Commenters have noted that while it’s fair for each partner to manage their own side hustles, the key is mutual respect. Some quip, “Money is money, but passion is priceless,” while others remind the OP that shared finances don’t have to mean losing personal identity. Do these opinions reflect your own experiences, or do you see the issue differently?