AITA for not returning money my ex-husband sent to me mistakenly?

Mornings can sometimes bring surprises that aren’t quite the “wake-up call” you’d hope for—especially when it involves money you never expected. In this story, a woman in her early 50s, who’s been courageously battling cancer for decades, finds herself at the center of a financial and emotional storm.

After her ex-husband mistakenly transferred two hefty payments into her account while she was sleeping off a double shift, she later remembered that he owed her a substantial sum from a loan given four years ago. Rather than returning the full amount, she decided to deduct his long-overdue debt before sending any money back.

Her decision has since ignited heated debates and stirred up strong opinions among friends, family, and the online community. With four children in the mix and a complicated past, her move isn’t just about money—it’s about setting boundaries and holding people accountable for their promises. Let’s dive into the details of this controversy and explore whether her decision is justified or if she’s taken things too far.

‘AITA for not returning money my ex-husband sent to me mistakenly?’

When it comes to correcting financial mistakes, clarity and fairness are key. Financial experts often stress that mistaken transfers should ideally be rectified quickly. However, if there’s an outstanding debt, it’s reasonable to consider it when returning funds. As noted by financial advisor Dave Ramsey in his many discussions on debt management, “You should always address debts head-on, as they can cloud judgment and complicate personal finances.”

In this case, the woman’s decision to subtract a $12,000 debt from the mistakenly transferred funds might seem unorthodox, but it reflects a longstanding issue that has been ignored for years. Balancing ethics with practicality is no easy task. On one hand, there’s an expectation of honesty—return the money as soon as you notice the mistake. On the other, ignoring a debt that has burdened you for four long years can feel like reclaiming fairness.

Legal experts would remind us that while banking errors should be corrected promptly, any legitimate, documented debt can be used as leverage to settle old accounts. In essence, her choice underscores the importance of accountability in financial relationships. This case serves as a reminder that personal finances are rarely just numbers—they’re deeply intertwined with trust and responsibility.

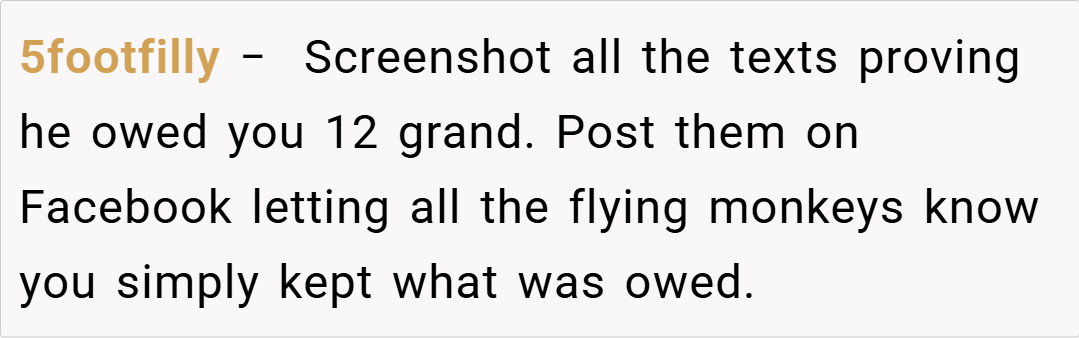

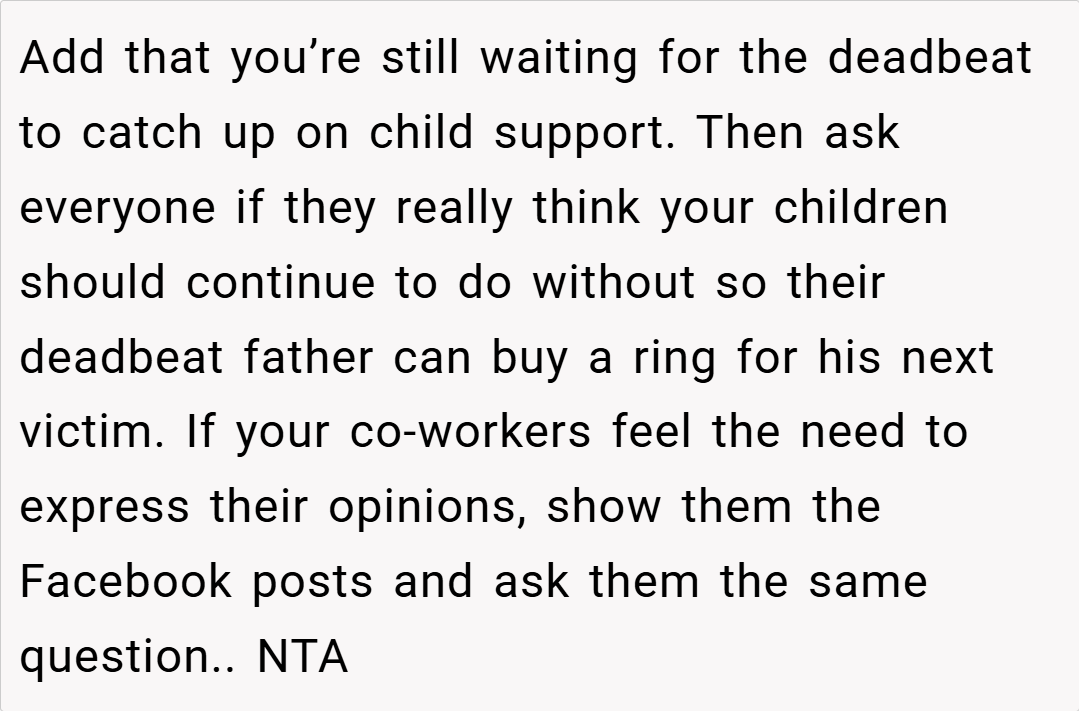

Here’s the feedback from the Reddit community:

Redditors largely rally behind her decision. Many emphasize that the debt had been pending for years and argue that deducting it from the mistakenly transferred amount is a fair move. Others point out the irony that he could afford to mistakenly transfer such large sums but somehow couldn’t pay back what he owed. The consensus seems to be that, while financial mistakes should be corrected, old debts shouldn’t be swept under the rug.

This story taps into a broader conversation about accountability and fairness in financial dealings. Is it fair to treat a mistaken transfer as an opportunity to finally settle a long-overdue debt? Or should personal finances be compartmentalized, with errors corrected separately from old obligations? While many support her bold move,

others worry about the potential legal and ethical implications of deducting debt in this way. What do you think—should you always return mistaken funds in full, or is it acceptable to use the opportunity to reclaim money that’s rightfully yours? Share your thoughts and experiences in the comments—let’s explore where we draw the line between financial error and personal justice.