AITA for not giving my late husband’s mom any of the life insurance money after she paid for his funeral?

Losing a spouse is heartbreaking enough, but when the grief is compounded by financial and familial disputes, the pain can feel overwhelming. In this story, a woman in her early 40s recounts how her world was shaken when her husband died suddenly after six years of marriage. In the midst of her sorrow, his mother stepped in and paid for the funeral expenses—a kind gesture she desperately appreciated in her fog of grief.

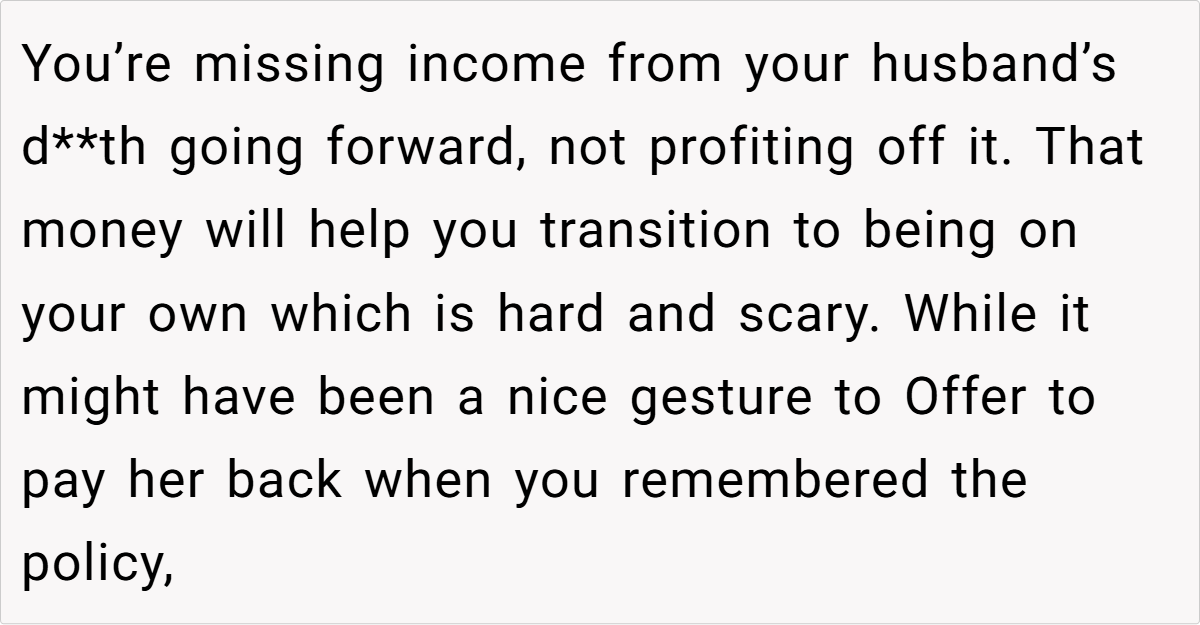

However, life took an unexpected turn when she discovered her husband had a small life insurance policy through her job. The resulting payout, though modest, represents a lifeline for her future—enough to help her move back across the country and possibly put a down payment on a new home.

Now, her late mother-in-law is demanding repayment for the funeral costs, accusing her of “using” her son. The burning question remains: Is she the asshole for keeping the insurance money for herself as she tries to rebuild her life?

‘AITA for not giving my late husband’s mom any of the life insurance money after she paid for his funeral?’

Navigating financial matters after the sudden loss of a loved one can be fraught with emotional complexity. When personal funds—like a life insurance payout—become a point of contention, it is crucial for both parties to understand that the money is meant to serve as a financial safety net for the designated beneficiary. As relationship expert Dr. John Gottman has noted, “Clear financial boundaries are essential during times of loss; they help preserve personal healing while maintaining respect for all involved.”

In this case, the insurance payout was claimed in the midst of acute grief and without prior knowledge that such a benefit existed. The arrangement with her husband’s mother before the claim was that she would cover the funeral costs—a gesture made out of love and necessity. Financial expert Suze Orman often stresses that a life insurance policy is intended to provide security for the beneficiary, regardless of any previous contributions toward one-time expenses. The funds, therefore, rightfully belong to the individual who files the claim, especially when they are crucial for rebuilding one’s life after tragedy.

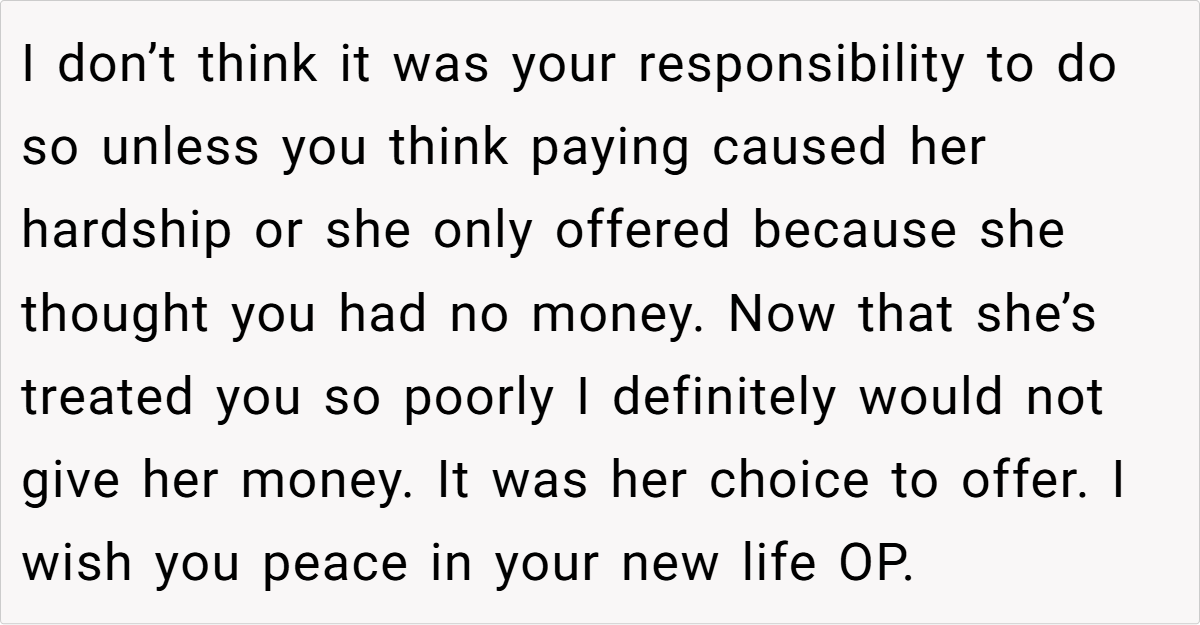

Moreover, while it is understandable that the mother-in-law may feel entitled to some compensation for the expenses she covered, these costs were voluntarily assumed during a time of crisis. If she wished to be reimbursed, it would have been appropriate to discuss that arrangement before the claim was filed. The current dispute appears less about the money itself and more about underlying feelings of loss, entitlement, and unresolved grief. Establishing and respecting financial boundaries during such turbulent times is not only practical—it is necessary for healing.

It is important for both parties to recognize that personal financial decisions made in the wake of a loss are part of a broader process of coping with grief. The beneficiary’s decision to use the insurance payout to secure a stable future is not an act of selfishness but rather a step toward regaining control and rebuilding a shattered life. Open, empathetic dialogue and possibly mediation or counseling might help all involved clarify expectations and ease the emotional charge surrounding these finances. After all, honoring a lost loved one and supporting one’s own future need not be mutually exclusive.

Let’s dive into the reactions from Reddit:

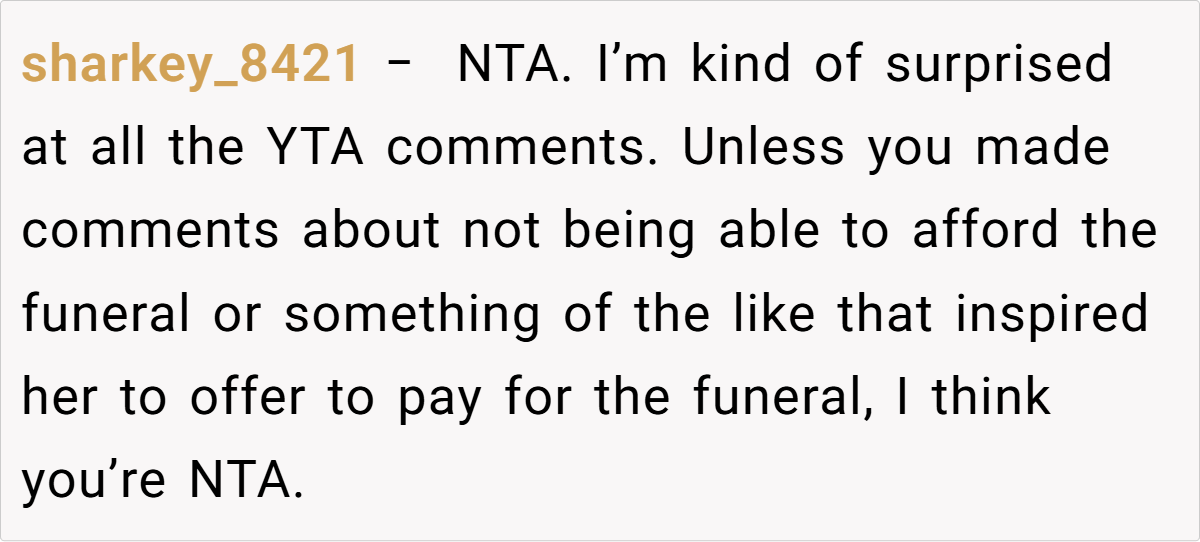

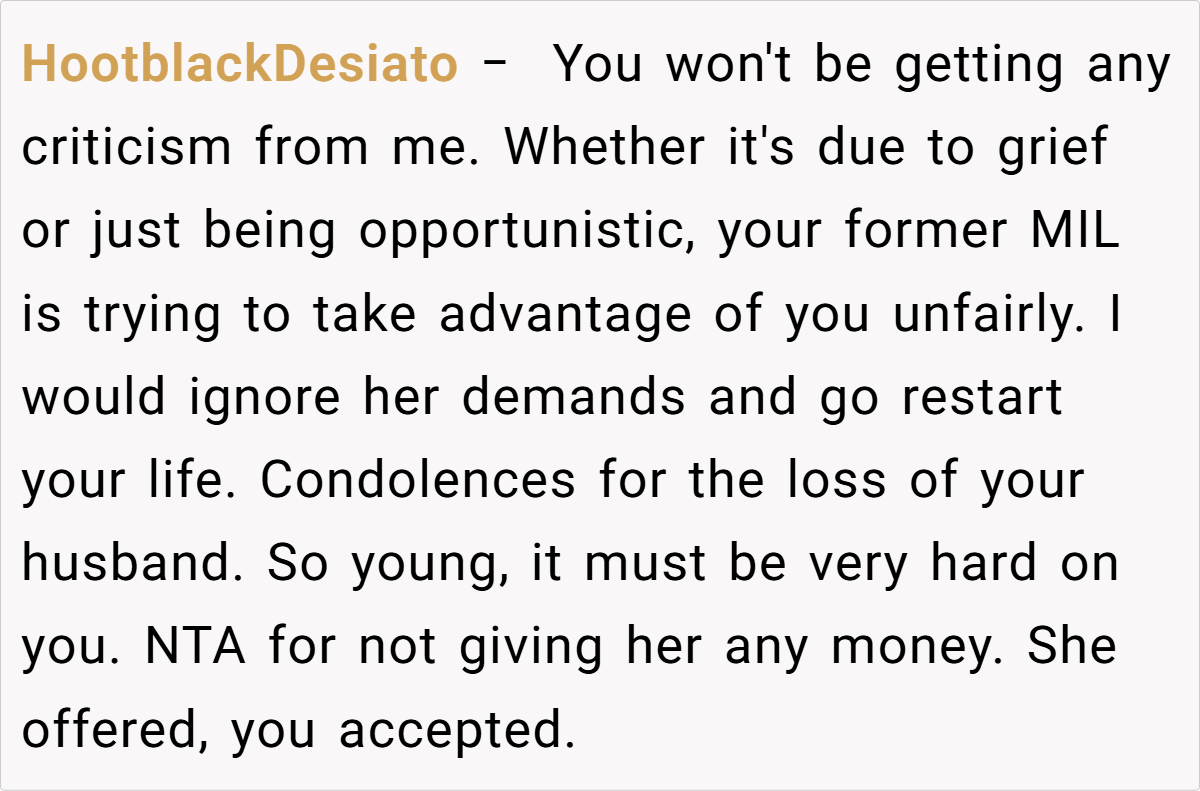

Some commenters agree that the insurance payout is the sole right of the beneficiary, noting that “funeral expenses were paid out of love, not as an advance on inheritance.” Others quip, “If you’re paying for a funeral, you shouldn’t expect a refund when the insurance check comes in!” While opinions vary, many remind us that financial boundaries and personal healing should come first in times of loss.

Ultimately, this situation highlights a difficult intersection of grief, financial responsibility, and family dynamics. The life insurance payout is meant to provide a much-needed safety net for the surviving spouse, not to reimburse expenses already willingly covered in a time of crisis. While your mother-in-law’s feelings of entitlement may stem from her own grief, the decision to use the money for your future is both reasonable and necessary for your healing.

What do you think? Should personal financial benefits remain entirely separate, even when a family member has helped with immediate costs? Or is there room for compromise when emotions run high? Share your thoughts and experiences—your insights might help others navigate similarly complex situations.