AITA for not buying my wife a plane ticket so she is missing the family vacation?

In every marriage, money can be both a bonding agent and a battleground. Our story today revolves around a husband who grew increasingly frustrated as his wife’s spending habits spiraled into mounting credit card debt. At the start, pooling finances seemed like a great idea, until irreconcilable differences in spending emerged, turning everyday decisions into high-stakes negotiations. The tension reached a boiling point when an upcoming family vacation became the latest flashpoint in their ongoing money drama.

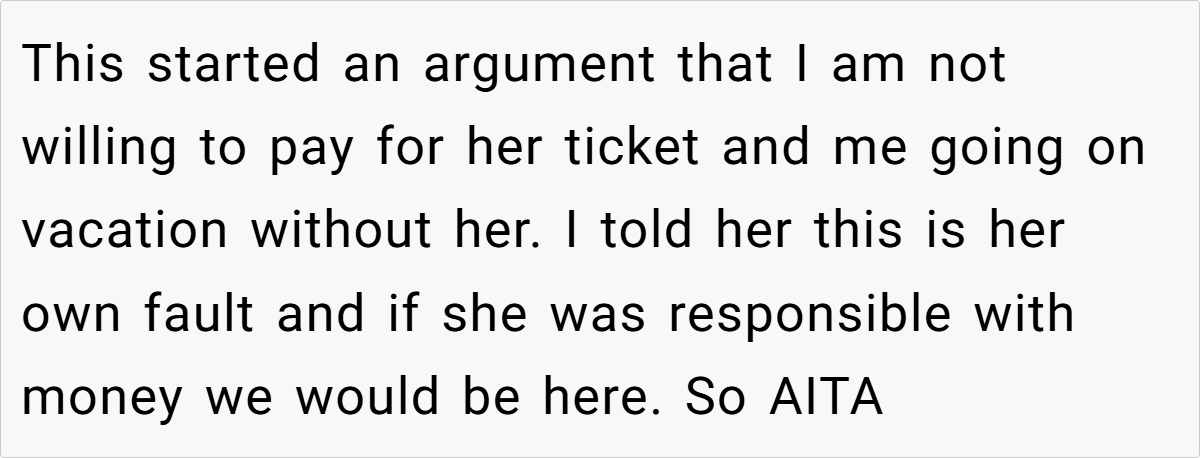

As plans for an exciting European getaway were announced, the couple’s financial disagreements took center stage. With the husband insisting that saving for a plane ticket was non-negotiable and the wife prioritizing debt repayment, the clash of priorities set the stage for a modern marital showdown. It’s a situation that many can relate to—where love, money, and pride intertwine in unexpected ways.

‘AITA for not buying my wife a plane ticket so she is missing the family vacation?’

Letting finances dictate the tone of a relationship is never simple. When couples merge money without clear boundaries, even small differences in spending habits can lead to major conflicts. In this case, the husband’s frustration reflects a broader issue: a lack of shared financial goals. The clash isn’t just about a vacation ticket—it’s about trust, responsibility, and how financial mismanagement can erode the foundation of a relationship.

The situation clearly illustrates how personal money management and relationship dynamics are deeply intertwined. On one hand, the wife’s past habits of depleting shared funds have led to serious consequences, including accumulating credit card debt. On the other hand, the husband’s decision to segregate finances and impose ultimatums appears to be his way of reining in those habits. This tug-of-war between fiscal responsibility and marital support is a recurring theme in many households, making it a subject ripe for expert analysis.

Socially, this case raises broader questions about how couples negotiate financial responsibilities. According to financial expert Dave Ramsey, “Debt is dumb, and couples need a clear, unified plan to avoid falling into financial traps that can undermine their future together.

His perspective emphasizes that while individual responsibility is crucial, a partnership requires open dialogue and mutual support to achieve lasting financial stability. In situations like these, maintaining empathy while setting firm boundaries is key to preventing resentment from building up over time.

Taking this expert advice into account, it seems that both partners have roles to play. The wife’s efforts to repair her credit show initiative, yet the husband’s punitive approach—excluding her from a family vacation—might further strain their relationship.

Instead of resorting to punishment, seeking a balanced strategy that includes shared financial counseling could foster a healthier dialogue. Encouraging joint planning might not only help clear debts faster but also rebuild trust over time. Ultimately, achieving financial harmony requires both accountability and compassion.

In light of these complexities, advice from seasoned counselors suggests that couples adopt a more cooperative approach. A balanced plan might involve setting realistic budgets, scheduling regular money talks, and even consulting with a financial therapist to navigate the emotional challenges of debt. Such measures can transform a battleground into common ground, turning financial hardships into opportunities for growth and mutual understanding.

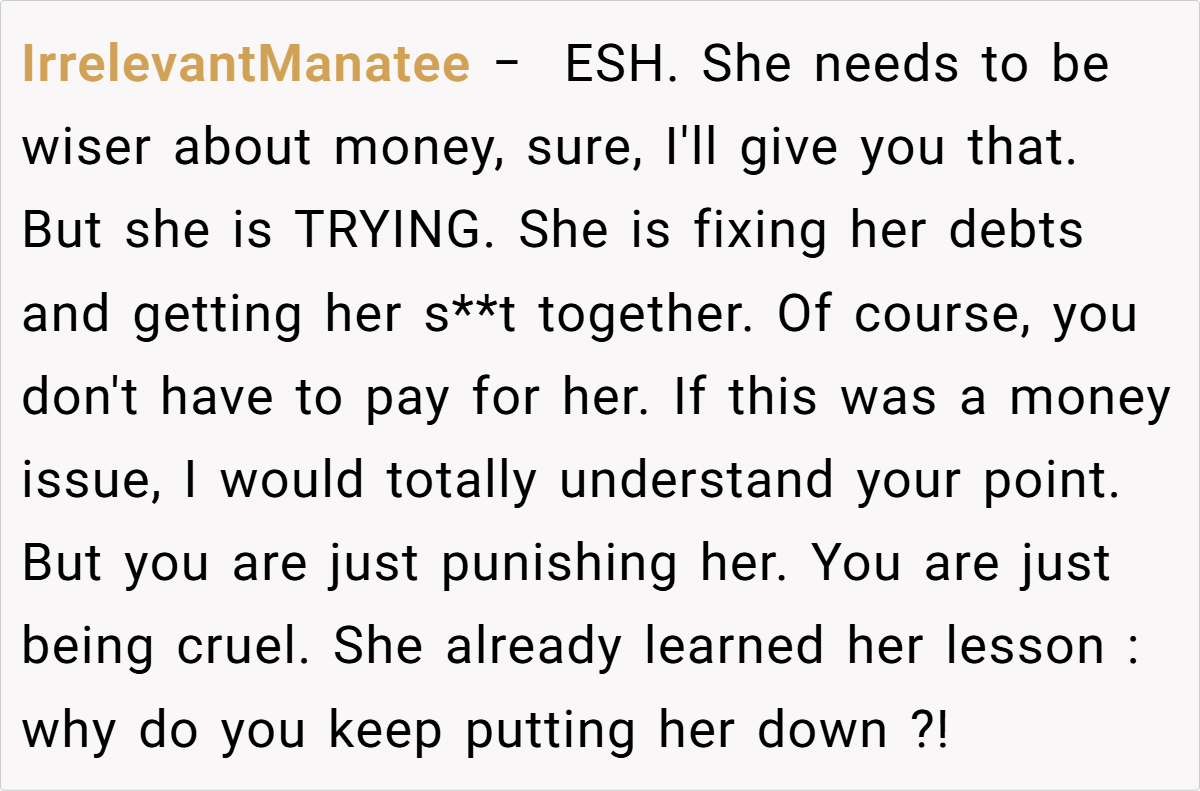

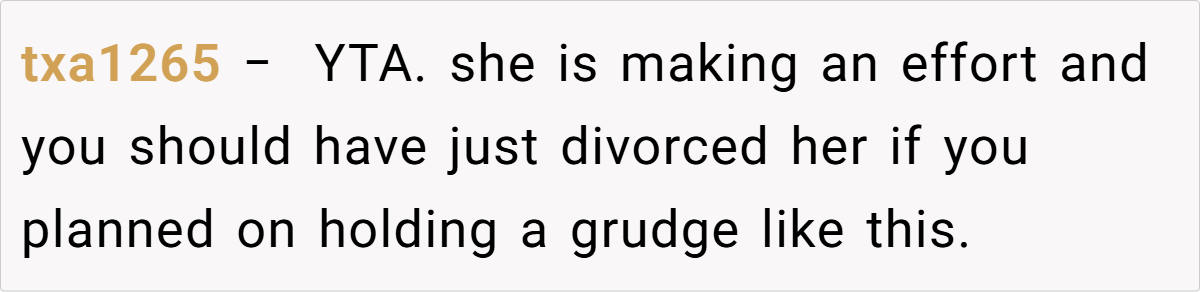

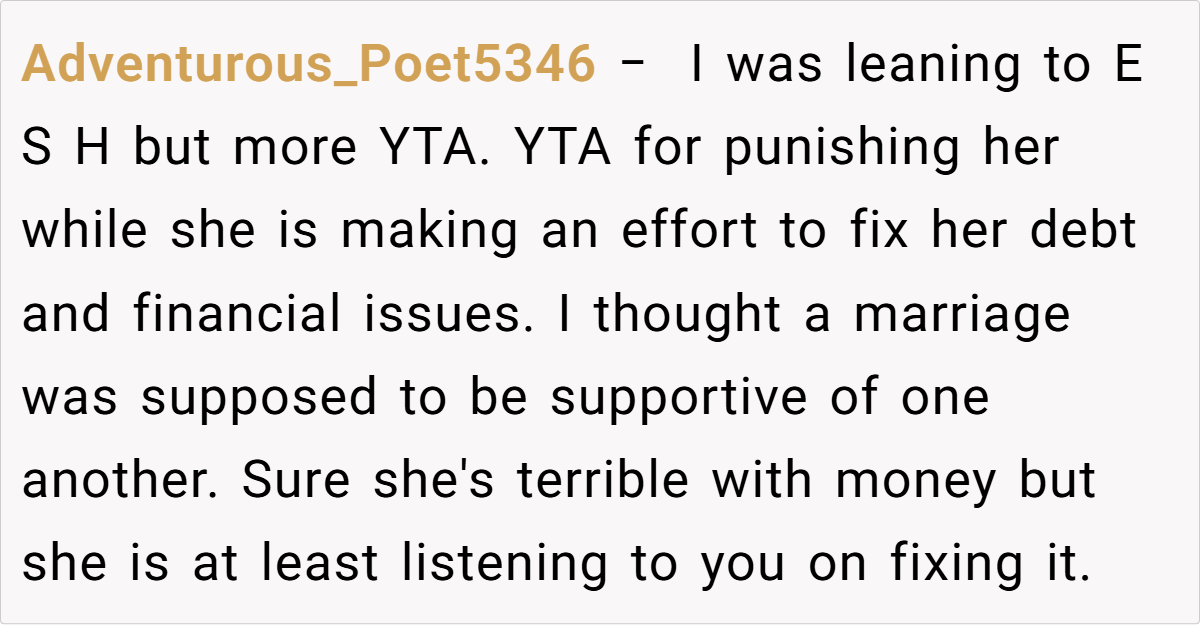

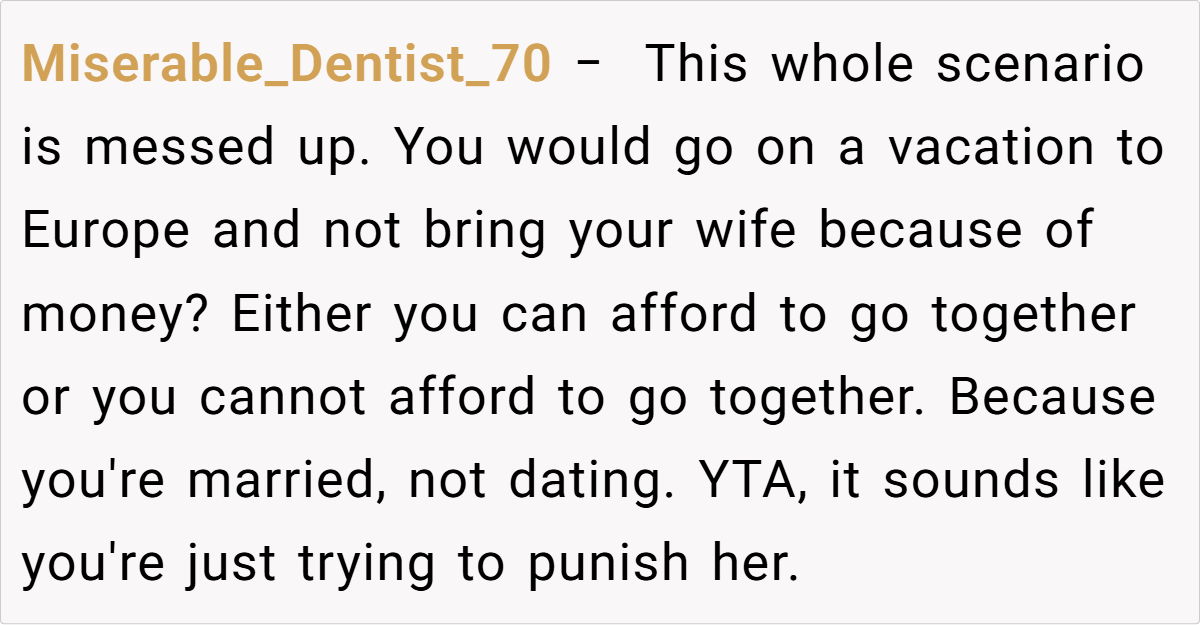

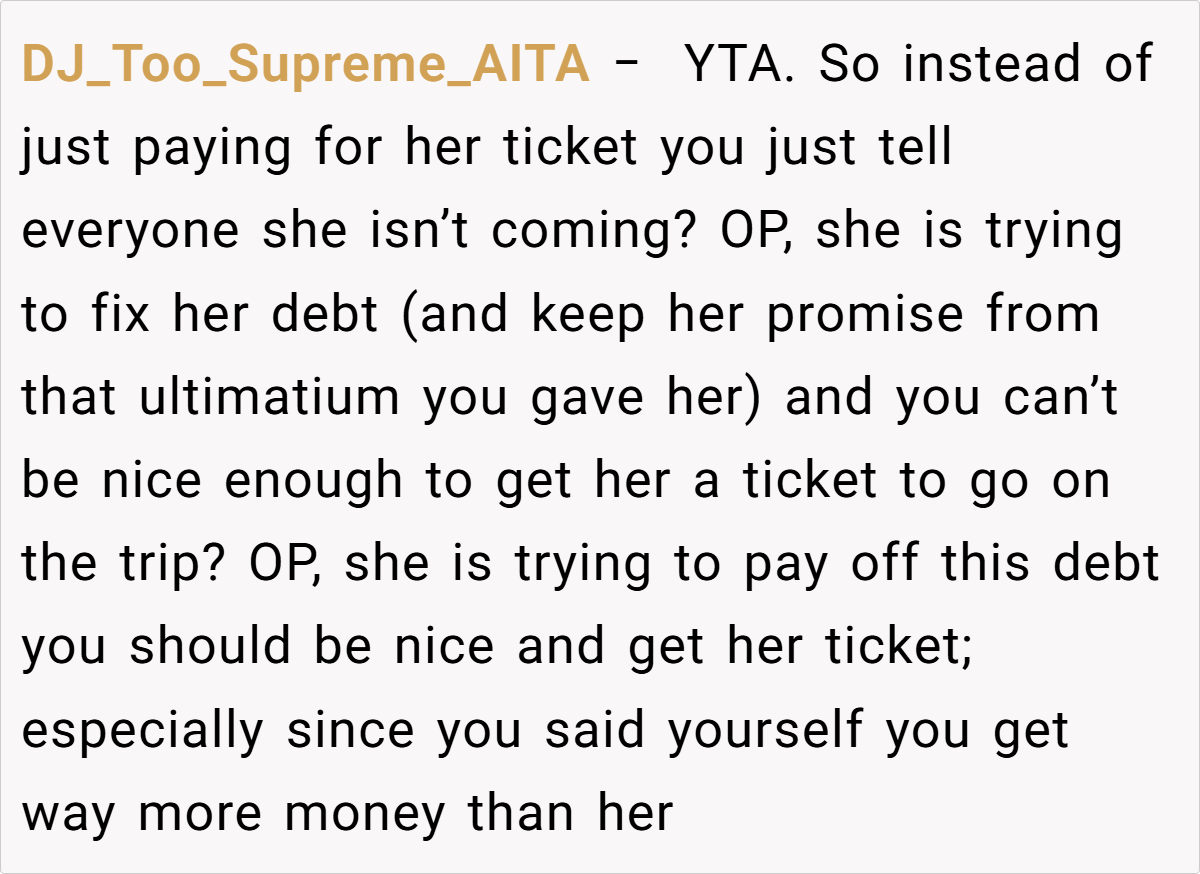

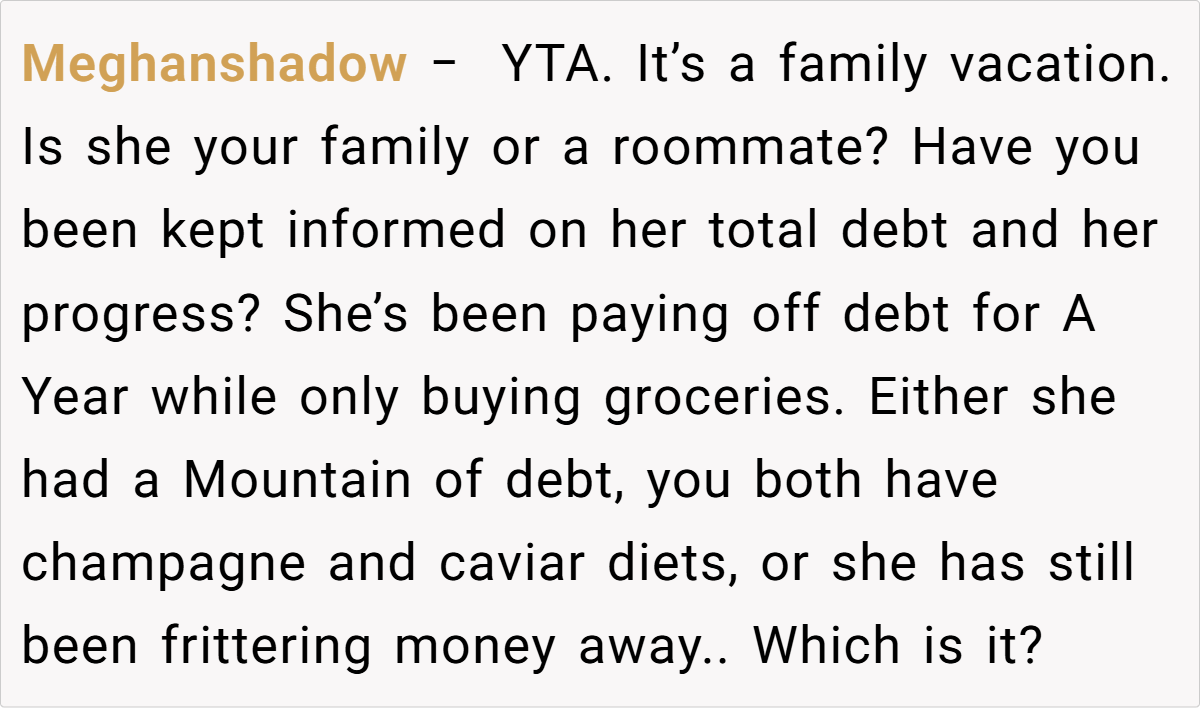

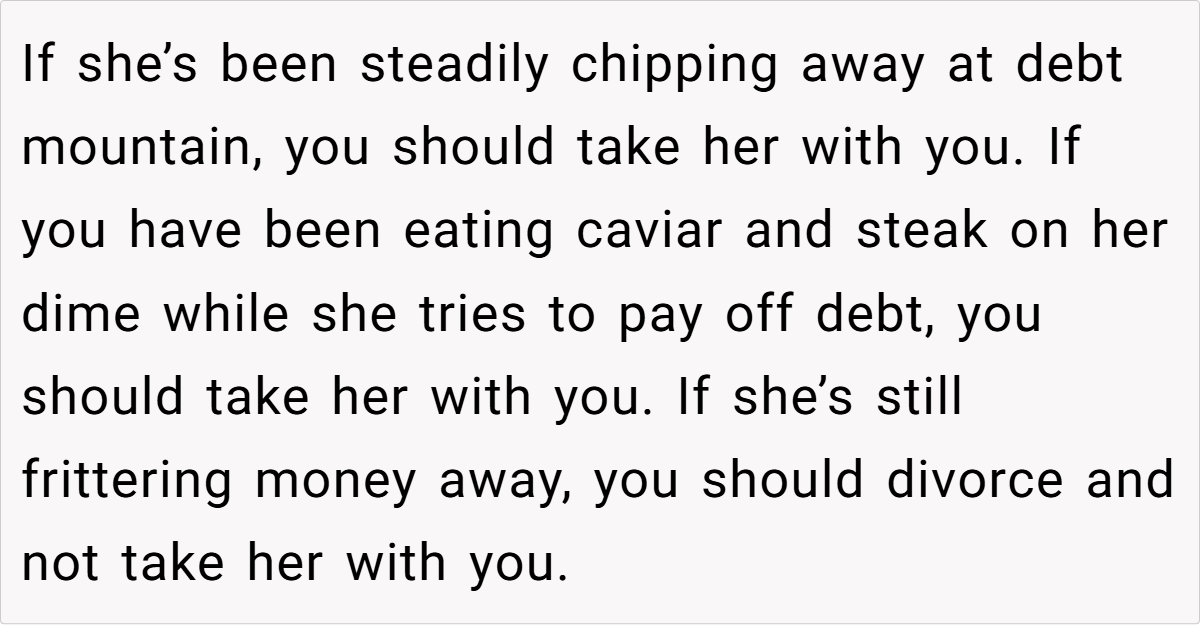

Here’s the comments of Reddit users:

Across Reddit, the overall consensus is that the husband’s decision to exclude his wife from the vacation feels overly punitive. Most redditors sympathize with the challenges of managing debt but criticize the approach of using a family event as leverage. The community feels that while financial accountability is important, relationships thrive on support and shared experiences—especially in times of hardship. Ultimately, many voices urge a more compassionate and cooperative solution rather than turning personal struggles into public punishments.

In the end, the delicate balance between personal responsibility and marital unity remains at the heart of this debate. While financial discipline is crucial, isolating a partner during tough times might only deepen the divide. What do you think—should financial missteps be met with tough love, or is there room for a more empathetic, collaborative approach? Share your thoughts and experiences below; your perspective might just help someone navigate a similar situation.