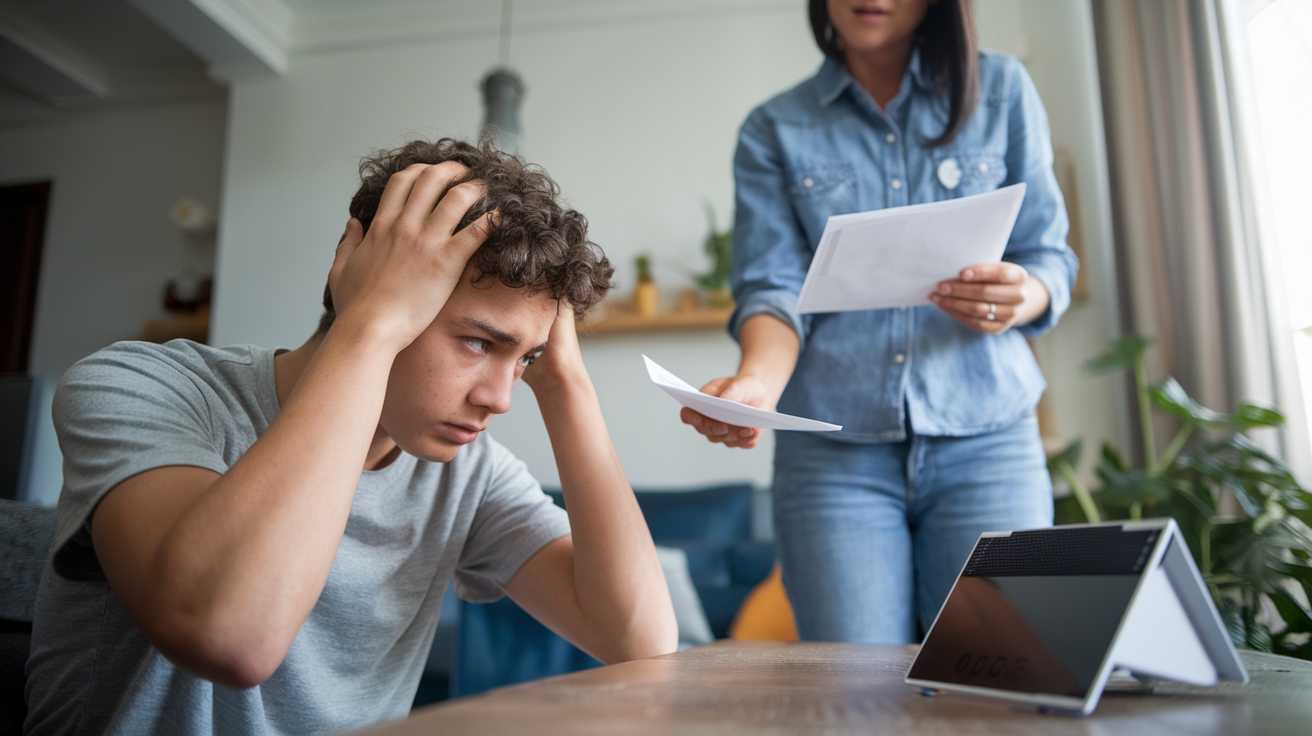

AITA for giving my son a bill for half his expenses?

A Redditor (40F) shares a situation where her son (17) asked for a new gaming system, and after refusing, he presented a budget showing how they could afford it. To teach him about the cost of living.

She gave him a detailed bill for half of his monthly expenses, revealing that the child support she receives doesn’t even cover a fraction of what she spends. Her ex is now upset, saying it made their son feel like a burden. Read the original story below…

‘ AITA for giving my son a bill for half his expenses?’

My son (17) asked me for a new gaming system and I said no because he already has plenty of gaming systems and games and doesn’t need more. If he wants one he can save up and buy one. He then comes to me with a budget on how we can “afford” the system. It was mostly just that if I buy nothing for myself for 2 months, we’ll have enough for the system.

I told him hell no, it’s offensive and if he wants the system he has to save up for it. Then he comes back with another budget. He and his father calculated how much I’ve been paid in child support over the years and they decided it would be a good idea to let me know how little a drop in the bucket the gaming system would be.

I told him I spend that on his expenses every month but he didn’t believe me, so I told him that if he doesn’t think so, he can pay me for his expenses every month and I’ll give him the child support. Surprise surprise, when I gave him the bill, it showed that when you factor in all of the things I pay for in a month, it’s much more than child support.

Child support doesn’t even cover 30%. Now my ex is yelling at me for making our son feel like an expensive burden, but I think I was teaching him a lesson about money and unteaching him some of what my ex says about support. AITA for giving him a bill?

Here’s what the community had to contribute:

chatondedanger − NTA. If his father wants to interject, why doesn’t he buy the system? That being said, I would sit down and explain that he isn’t a burden but new gaming systems are a luxury item. You can maybe help him come up with a strategy to save his own money or suggest he take on work outside the home. He is going to be an adult soon.

pineboxwaiting − NTA Your son was way out of line to come to you with his child support numbers. That was Dad stirring the pot, but your son’s 17 & was being an ass.

Go to your kid & tell him that you knew he was going to be expensive when you had him & that you love him more than money & always will. PS – your ex is a d**che who doesn’t like his kid knowing how much MORE you’ve done for your son financially

HighPriestoftheBog − NTA. It would have been an AH move to give your son a bill just to shame him, but that’s not what you did. Your son was incredibly entitled and rude to you. He and your ex both implied you take the child support and spend it on yourself. You proved otherwise.

And you’re right. You did teach him a lesson about finances and how expensive it is to raise a child. EDIT: also, not that this isn’t obvious, but a gaming system isn’t a necessity. It’s important you also explain to him the difference between a want and a need. Bills, food, clothing, toiletries all need to come before luxuries.

CoastalCerulean − NTA I “love” how his dad feels entitled to all of his own paychecks after the small percentage he pays in childsupport- and he feels your son is entitled to 100% of your income because he pitches in a small bit of his own. 🙄

Sunshine61177 − NTA. If your son had all that time to come up with a budget so that you could afford to get a new gaming console (I’m assuming PS5 maybe?), then he can take that time and look for a part-time job to buy the console himself.

You didn’t give him the bill expecting him to pay it, but to give him an idea of just how expensive raising a child is. If your ex is yelling at you about YOUR bills, then he can either chip in for the system, up the child support, or keep his nose out of your finances.

PROXENIA − NTA. Well played. He needs to learn (sounds like his dad does too). Why on earth doesn’t his dad buy it for him if he thinks it’s such a good idea?

somebodyatemytoaster − NTA your ex was being being rude helping your son scheme to try and guilt you into buying him something expensive saying child support would cover it. Your son was also being rude suggesting you not spend any of your hard earned money on yourself and accusing you of not using child support to cover his expenses.

I think this is a good lesson for your son. As a teenager myself I understand how a lot of kids don’t understand the value of money and I think this is a good way to teach him.

You never said he was a burden you just showed him how much you spend on him so he would understand why you didnt wanna buy him something so expensive that he doesnt need out of no where. That was an entitled way to act assuming he deserves it for no reason.

wordsinotherwords − NTA. Your son is almost an adult and if he views pressuring someone to going without so he can have what he wants then he needs to learn a lesson. Your ex sucks for drafting that second budget with your son based on child support over the years…

Trilobyte141 − NTA, although I would clarify to your son that he is not an expensive burden – he’s a *child*. You do not mind at all paying for everything it takes to take care of him, but ‘every new gaming system he wants’ is not on the list of childhood necessities.

SeePerspectives − NTA. Reassure your son of how much you love him and have never regretted the expense, and point out to his dad that if he feels so strongly that your son deserves the console maybe he could use some of the money he’s saved by not being main carer to buy it.

It’s a tough balance between teaching responsibility and maintaining healthy family dynamics. Did the Redditor overstep by giving her son a bill, or was it a valuable lesson in finances? Share your thoughts in the comments!