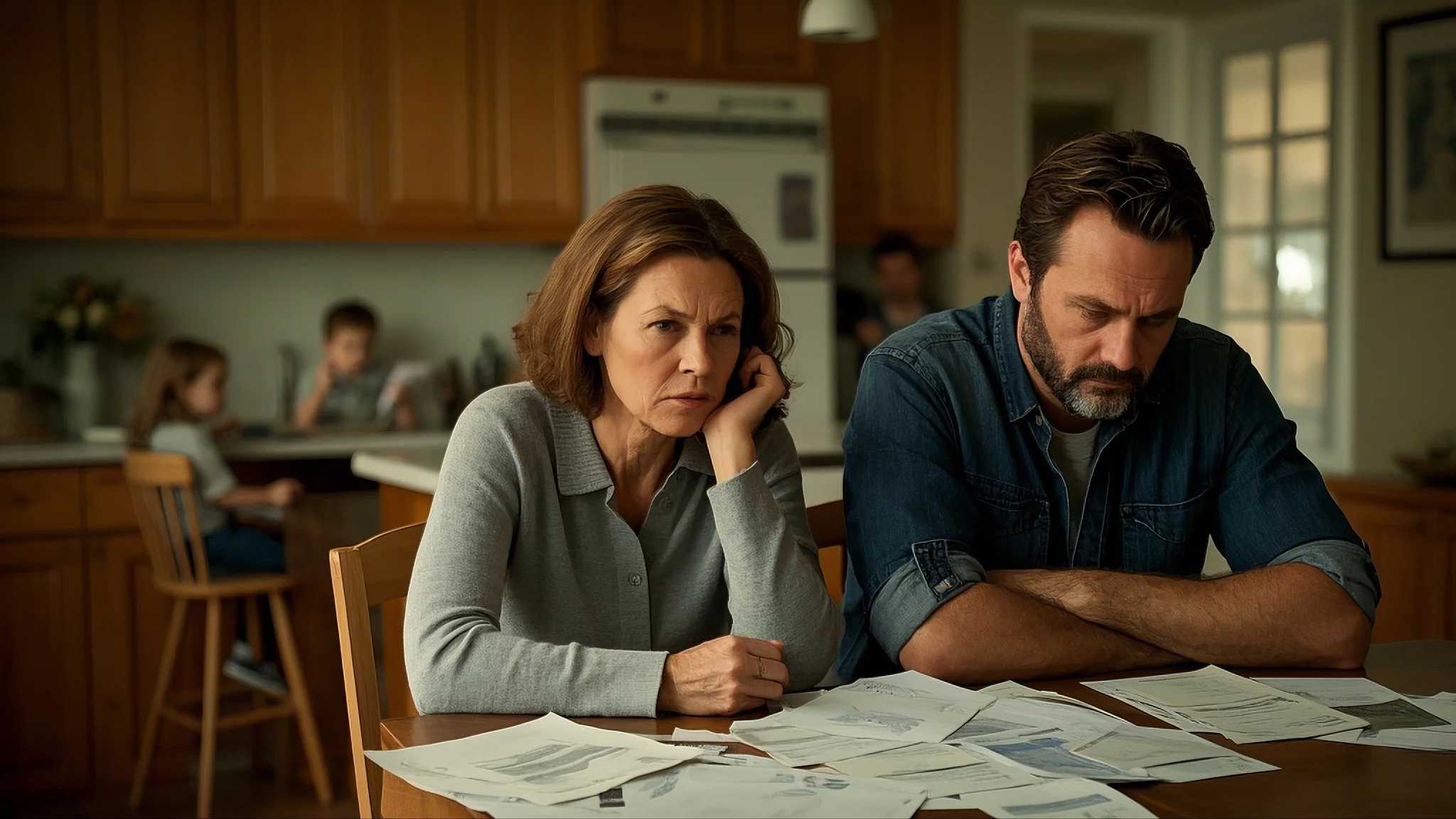

My husband 34M has put us 24k in debt. How should we move forward?

A Reddit user (34F) shared that her husband (34M) has put them $24,000 in debt due to gambling, despite multiple attempts to stop. After being blocked from gambling apps and lying about playing free games, he recently admitted to their financial troubles.

The couple has two young children and a large mortgage, and while the wife doesn’t want a divorce, she’s concerned about her husband’s gambling addiction and how to move forward.

She’s considering buying him a new phone with limited access to one account, but she feels unsure how to handle the situation. To read the full story and see how others are weighing in, check out the post below.

‘ My husband 34M has put us 24k in debt. How should we move forward ?’

As the title states, my husband who has recently been to GP to be put on waitlist for ADHD has been using gambling apps to make a quick buck. It started earlier this year and when he lost 1,000 he agreed to stop.

Mainly because I ended up paying the mortgage that month as it didn’t go through on his bank due to overdraft. I thought it was over as he said he felt terrible and learnt his lesson. Then he started up again around summertime and claims he won 20k but also had 9k in credit card so I suggested to pay this off and keep rest in savings account.

He didn’t. He wanted to keep all the money in a savings account and keep paying off credit cards slowly via his wages as he stated its better to have available money and use it to gain interest. All his banks were then blocked to use on any gambling apps (even the national lottery was blocked).

I did catch him playing slots style games on his phone but he said these were free games and not real money. (Not sure why I believed him, maybe he was playing free ones too but obviously this is just a gateway) Well today, he’s come clean about being in big trouble.

Ive sat down and asked him for all banking details and gone into his accounts. We are 23k in the minus. I say “we”, they’re all his accounts but we are married. We have 2 kids under 5 and a 200k mortgage. He owns a second hand car and I own a second hand car.

He earns double than me but I work half the hours he does because of the kids. My question is how do we move forward from this? I cant guarantee that he’ll stop gambling. I don’t want to divorce. He’s a good dad and I don’t want to be a single mum over this.

I was thinking to buy him a new crappy phone so he only has access to one bank account which I’ll deposit funds into from his wages. He’s agreed to only using one account but I don’t trust him on his phone anymore.. Any advice?

See what others had to share with OP:

amidtheprimalthings − Your husband is an addict. He is also not a good dad or partner when he is gambling away family resources and landing you in debt multiple times. Sure, you can parent him (how sexy!) and take away his phone and scrutinize his every action.

But you can’t watch him all of the time and there’s nothing stopping him from taking out a second mortgage, cleaning out his retirement accounts, buying a burner phone at the store, gambling in person, or using your/your children’s identities as access points to additional means and methods of gambling.

Your husband is addicted to gambling and does not care that it could cost you your home, financial future, and family solvency. He needs to be in a rehabilitative program specifically targeted towards gambling. Barring that, you need to separate.

You also need to lock yours and your children’s credit and think about what you’re teaching them by staying in an unstable situation in which your husband prioritizes his d**g of choice (gambling high) over being a good partner and father.

themagicchicken − Obviously, your husband is not good with money, but this gem made me double-take: “He wanted to keep all the money in a savings account and keep paying off credit cards slowly via his wages as he stated its better to have available money and use it to gain interest.”

Is he making interest more than the APR for his credit card? That would be really, really surprising. Then again, this may have been something he needed to say so you wouldn’t go peeking through the finances.

You need to get more control over the family finances while he’s dealing with his gambling problem. You mentioned getting him a new crappy phone–I’d recommend a dumb phone, just for making calls.

SuluSpeaks − File for divorce. It stops the clock on what you are responsible for when it comes to splitting assets and liabilities. If you stay married and he continues to run up debt, you could be responsible for 50% of it in the divorce.

How would you like to start single life with 3 kids and tens of thousands of dollars in debt? He’s not going to be able to pay a whole lot of child support, because he’s got huge payments to make, too. If you’ve been on this subreddits, you’ll see how easy it is for divorced dads to prioritize other things in their new lives, and put their children second.

It’s unlikely that your marriage will come back from this, and even if he tries to turn his life around, there will probably be relapses. You’ve got to protect your kids. Get an appointment with a lawyer ASAP!

DiTrastevere − Gambling addictions are arguably the most ruinous for the families of the addicted. There is no physical limit to how much damage a gambling addict can do. ADHD treatment is not enough. He needs to seek out addiction treatment,

and give up *all* access to the family’s money until he is solidly in recovery. No smartphone either – too much temptation. And you need to see a fiduciary *immediately* to get a plan together for the debt. Otherwise, there is no saving this marriage.

venturebirdday − You already know he is an addict. If he were a heroin user, what would you do? Think in those terms. If he were a heroin user would you understand that addicts are capable of doing ANYTHING to serve their master? He is a slave to the gambling.

He has already proven that he is willing to sacrifice everyone else to serve his master. Do not try logic. Understand that he will get better at hiding it but quitting is a long road and he may or may not be willing to travel it. Now to the next step, if you want to stay, together you need to take practical steps.

Take all the credit cards. Change all the passwords. Take his name off all the accounts. Freeze both your credit through the big three services. Make him sit with you and go through every transaction detail. It needs to be laid bare. Every u**y worm needs to see the light of day.

For his part: sign up for and ATTEND gambling addiction support programs, get a second job, get a phone that does not allow apps. If he is unwilling to do any of the above, well . . .you know you are the side piece and he is married to the gambling. I am so sorry for you and the kids. Thrill seeking kills so many families.

SnuggleByte91 − I am a recovering gambling addict. Clean over 2 years now. I took out loans to get the money to fuel my addiction. I even went as far as to get a credit card in my ex’s name and max it out. In total, it was approximately 20k, and it tanked my credit score and my ex husband’s started to as well.

I did not care about how it would affect my family, my living situations, my pets. Nothing. I only cared about the next big hit. I was selfish and only cared about me. Because, sure, I was down 100 bucks, but what if the next hit was double that? Then I’d be out of the hole.

The ONLY advice I have is, while you may not WANT to divorce, it may be the only way to save your family, your home, everything. I was not a “great mother” by jeopardizing our financial well being to the addiction. It affected our everyday lives, down to what we could afford to eat. The only way I stopped was to truly lose my safety net.

A2mm − He’s an addict and likely won’t ever stop. Think of it like this… him having any access to any money is like keeping heroin on the kitchen counter and expecting a heroin addict to walk past it every day and not touch it

You need to take over access to all income, including his income. Get his paycheck direct deposited into an account that only you have control over. Put a freeze on his SSN for getting credit cards.

stuckinnowhereville − You asked for a formal legal separation to separate your finances from his debt. And then you divorce him.

This is an addiction unless he wants to change he’s gonna drag you more into debt with him .

Kind-Dust7441 − It’s time to separate your marriage from your relationship. They are two different things, the first is a legal entity; the second is an emotional connection. You can end the marriage but maintain the relationship.

Divorce him in order to protect your financial future, and that of your children, while continuing to live and parent together. If he sincerely wants to try to repair your relationship, he should agree to stipulate in the divorce property settlement that he will be responsible for the debt he has already accrued and any future debt.

The property settlement should also stipulate how the household bills and maintenance will be split financially, what you will do with the house and how you will distribute the equity and any other assets. He should agree to terms that absolutely favor you monetarily.

Then, if he gets his addiction under control and you want to stay with him, you can remarry down the road. If he continues to gamble and looses even more money, you’re already divorced, and your property and assets divided in your favor.

NDaveT − I was thinking to buy him a new crappy phone so he only has access to one bank account which I’ll deposit funds into from his wages. You’re trying to manage his addiction for him. That won’t work and it will make you miserable.

I know you don’t want to get divorced but with any kind of addict that’s almost always the only viable option. If he got treatment – real, professional treatment – for his gambling addiction then you would have a sliver of hope. Without that there isn’t even a sliver.

Better you be single than swimming in debt. Dump him, he will not change and you will always be broke.