AITA for not using my inheritance (from my parents) for my husband’s family?

Family and finances can be a tricky mix—especially when an inheritance is involved. In this story, we explore a situation where a long-standing marriage and a cherished inheritance come into conflict with family obligations. The OP inherited a substantial sum from her parents, money meant to secure her future and that of her children. But her husband’s persistent demands to use that money for his sisters’ benefit on their farm have stirred up serious tensions, threatening both her financial independence and the harmony of her marriage.

For over three decades, the couple has built a life on the family farm, supporting extended relatives along the way. Yet now, when asked to use her hard-earned inheritance to build a home for her husband’s sisters, the OP finds herself questioning the true meaning of family loyalty versus personal financial security. Read on to learn more about this emotional tug-of-war and the lessons it might hold for us all.

‘AITA for not using my inheritance (from my parents) for my husband’s family?’

Before we move forward with a deeper analysis, here’s a brief look at the original Reddit post that sparked this debate:

Family finances often come with unspoken expectations, and in this case, those expectations have erupted into a full-blown conflict. The OP is faced with a stark choice: use her inheritance—money her parents worked tirelessly to provide—to benefit her husband’s family, or keep it secure for her children’s future and her own peace of mind. This isn’t just about dollars and cents; it’s about personal autonomy and the boundaries between extended family support and financial responsibility.

The OP’s situation highlights a broader issue that relationship and financial experts often discuss: the need for clear communication and firm boundaries when dealing with family money. According to financial advisor Suze Orman, “Inheritance is a personal gift meant to secure your future, not to subsidize others’ lifestyles.”

Her insight serves as a reminder that mixing personal wealth with family obligations can sometimes lead to unwanted complications. The OP’s husband appears to assume that because they share a long history of supporting family members, his sisters are entitled to a free ride—an assumption that many experts warn can lead to long-term resentment and financial strain.

Another key aspect here is the psychological burden of feeling obligated to support relatives who might not contribute equally. Family therapist Dr. Jenn Hardy explains that such imbalances can lead to a sense of entrapment, where one party feels constantly exploited.

In the OP’s case, her husband’s insistence to funnel her inheritance into a home for his sisters not only undermines her financial independence but also sets a precedent for future expectations. These experts agree that safeguarding one’s inheritance is not only prudent but essential for maintaining healthy family dynamics.

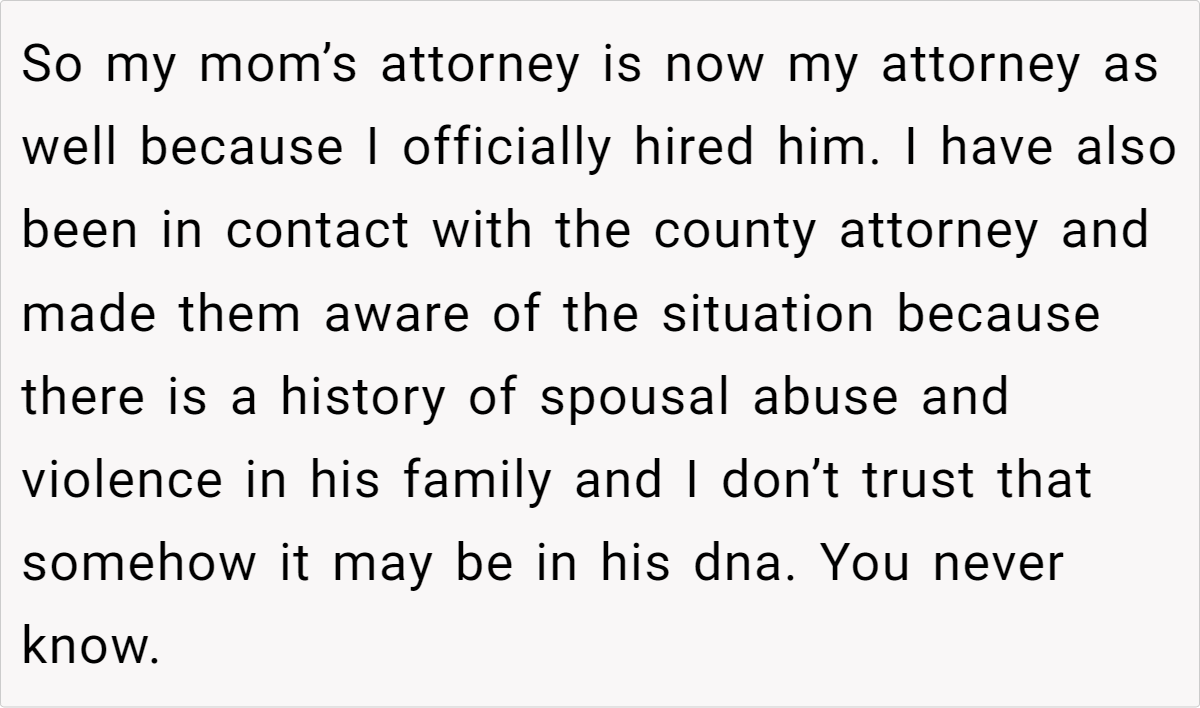

Moreover, the narrative points to an underlying issue of control and respect. The OP’s decision to keep her inheritance separate—along with the measures taken to protect it legally—illustrates a proactive step toward financial autonomy. It sends a clear message: personal resources, especially those earned or inherited with great sacrifice, should be managed according to one’s own goals and values.

This sentiment resonates with many who have faced similar dilemmas, underscoring that financial boundaries are as critical as emotional ones. Ultimately, experts advocate for a balanced approach where family obligations are honored without compromising individual financial security.

Here’s what Redditors had to say:

Here are some hot takes from the Reddit community—raw, candid, and laced with humor.

Many commenters agree that the inheritance is a personal asset, meant for the OP’s children and her own future. They argue that using it to fund her husband’s sisters’ housing is not only unfair but also sets a dangerous precedent for future financial demands. The consensus is clear: when it comes to inheritance, personal financial security should come first, even if that means facing family backlash.

At the end of the day, this story isn’t just about money—it’s about respect, independence, and setting healthy boundaries in family relationships. The OP’s dilemma forces us to ask: Should we sacrifice personal financial security for extended family obligations? And where do we draw the line between helping loved ones and preserving our own futures?

What would you do if you were caught between familial duty and personal independence? Share your thoughts and experiences in the comments below, and let’s spark a thoughtful discussion on balancing love, loyalty, and financial responsibility.